Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

The Future of Stablecoins: Key Drivers for 2025 and Beyond

The Future of Stablecoins: Key Drivers for 2025 and Beyond

The Future of Stablecoins: Key Drivers for 2025 and Beyond

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Sep 4, 2024

Sep 4, 2024

The stablecoin market has reached a $169 billion valuation in August 2024, propelled by global adoption and new projects.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, alongside collaborations between regulators and the private sector.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how CBDCs and stablecoins are reshaping global payments. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

The stablecoin market has reached a $169 billion valuation in August 2024, propelled by global adoption and new projects.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, alongside collaborations between regulators and the private sector.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how CBDCs and stablecoins are reshaping global payments. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

The stablecoin market has reached a $169 billion valuation in August 2024, propelled by global adoption and new projects.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, alongside collaborations between regulators and the private sector.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how CBDCs and stablecoins are reshaping global payments. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

Title - Paragraph 1

Title - Paragraph 1

Title - Paragraph 1

The stablecoin market has risen to a $169 billion valuation in August 2024, driven by global adoption and expanding public-private partnerships.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, making collaborations between regulators and the private sector increasingly important

The stablecoin market has risen to a $169 billion valuation in August 2024, driven by global adoption and expanding public-private partnerships.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, making collaborations between regulators and the private sector increasingly important

The stablecoin market has risen to a $169 billion valuation in August 2024, driven by global adoption and expanding public-private partnerships.

As we approach 2025, stablecoins are poised to play an increasingly integral role in the global financial system, making collaborations between regulators and the private sector increasingly important

Key Developments in Stablecoins

Key Developments in Stablecoins

Key Developments in Stablecoins

Stablecoins have become a critical force in global finance, combining the stability of traditional currencies with blockchain innovation. Their rapid growth reflects increased adoption within mainstream financial systems. Major players like PayPal have contributed to this trend, with PYUSD seeing significant increases in market cap and trading volume. In 2024 alone, new stablecoins worth over $40 billion were issued.

According to AMBCrypto’s August 2024 Crypto Market Report, the stablecoin market has rebounded with a 29% increase in total supply, reaching $168 billion by mid-August. Tether (USDT) and USD Coin (USDC) now dominate the space, commanding around 90% of the market share.

Key global financial markets are integrating stablecoins into their financial systems. For example, Hong Kong's stablecoin issuer sandbox, highlights the global push to incorporate stablecoins into existing frameworks, setting the stage for further advancements in 2025.

Stablecoins have become a critical force in global finance, combining the stability of traditional currencies with blockchain innovation. Their rapid growth reflects increased adoption within mainstream financial systems. Major players like PayPal have contributed to this trend, with PYUSD seeing significant increases in market cap and trading volume. In 2024 alone, new stablecoins worth over $40 billion were issued.

According to AMBCrypto’s August 2024 Crypto Market Report, the stablecoin market has rebounded with a 29% increase in total supply, reaching $168 billion by mid-August. Tether (USDT) and USD Coin (USDC) now dominate the space, commanding around 90% of the market share.

Key global financial markets are integrating stablecoins into their financial systems. For example, Hong Kong's stablecoin issuer sandbox, highlights the global push to incorporate stablecoins into existing frameworks, setting the stage for further advancements in 2025.

Stablecoins have become a critical force in global finance, combining the stability of traditional currencies with blockchain innovation. Their rapid growth reflects increased adoption within mainstream financial systems. Major players like PayPal have contributed to this trend, with PYUSD seeing significant increases in market cap and trading volume. In 2024 alone, new stablecoins worth over $40 billion were issued.

According to AMBCrypto’s August 2024 Crypto Market Report, the stablecoin market has rebounded with a 29% increase in total supply, reaching $168 billion by mid-August. Tether (USDT) and USD Coin (USDC) now dominate the space, commanding around 90% of the market share.

Key global financial markets are integrating stablecoins into their financial systems. For example, Hong Kong's stablecoin issuer sandbox, highlights the global push to incorporate stablecoins into existing frameworks, setting the stage for further advancements in 2025.

Global Regulatory Frameworks

Global Regulatory Frameworks

Global Regulatory Frameworks

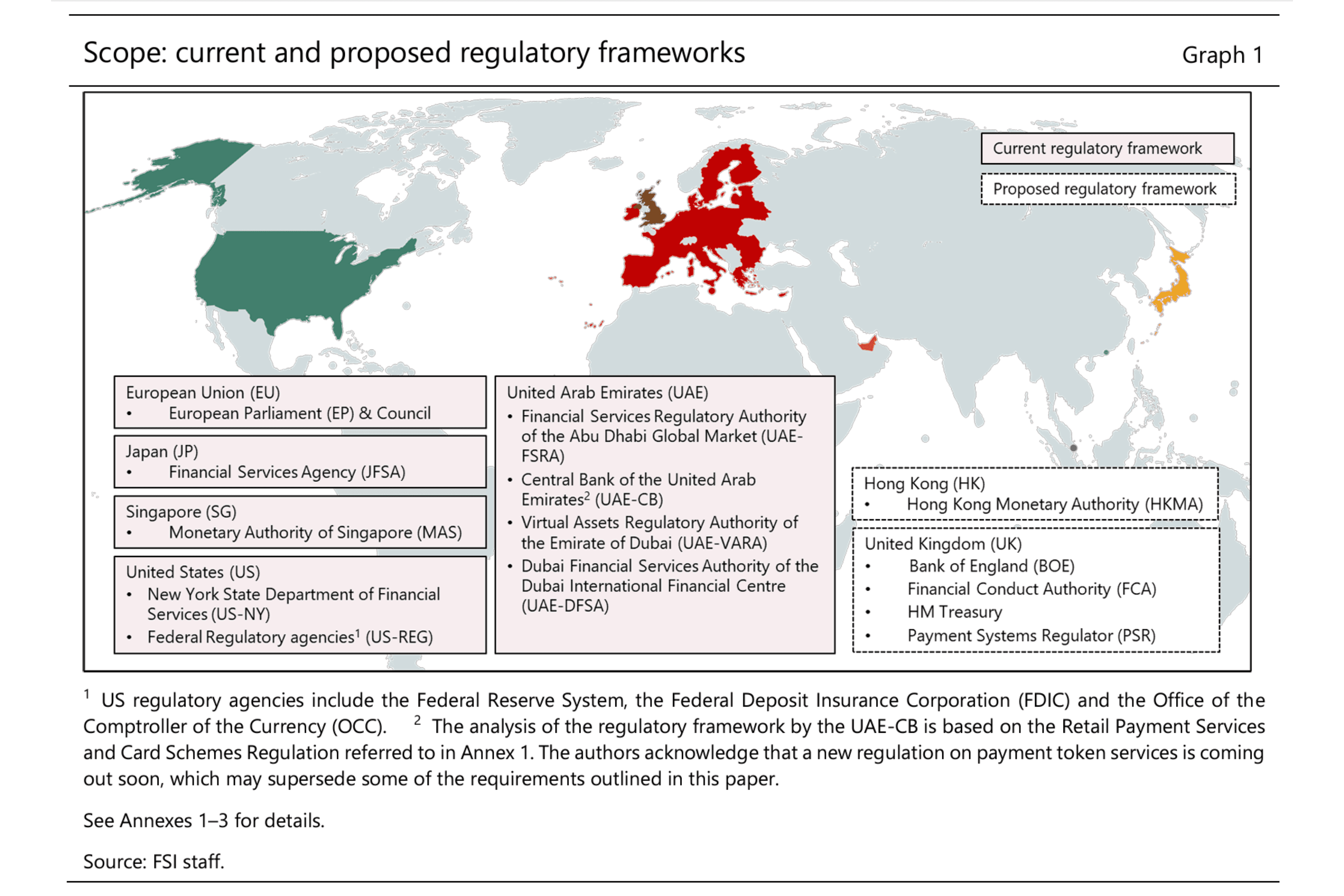

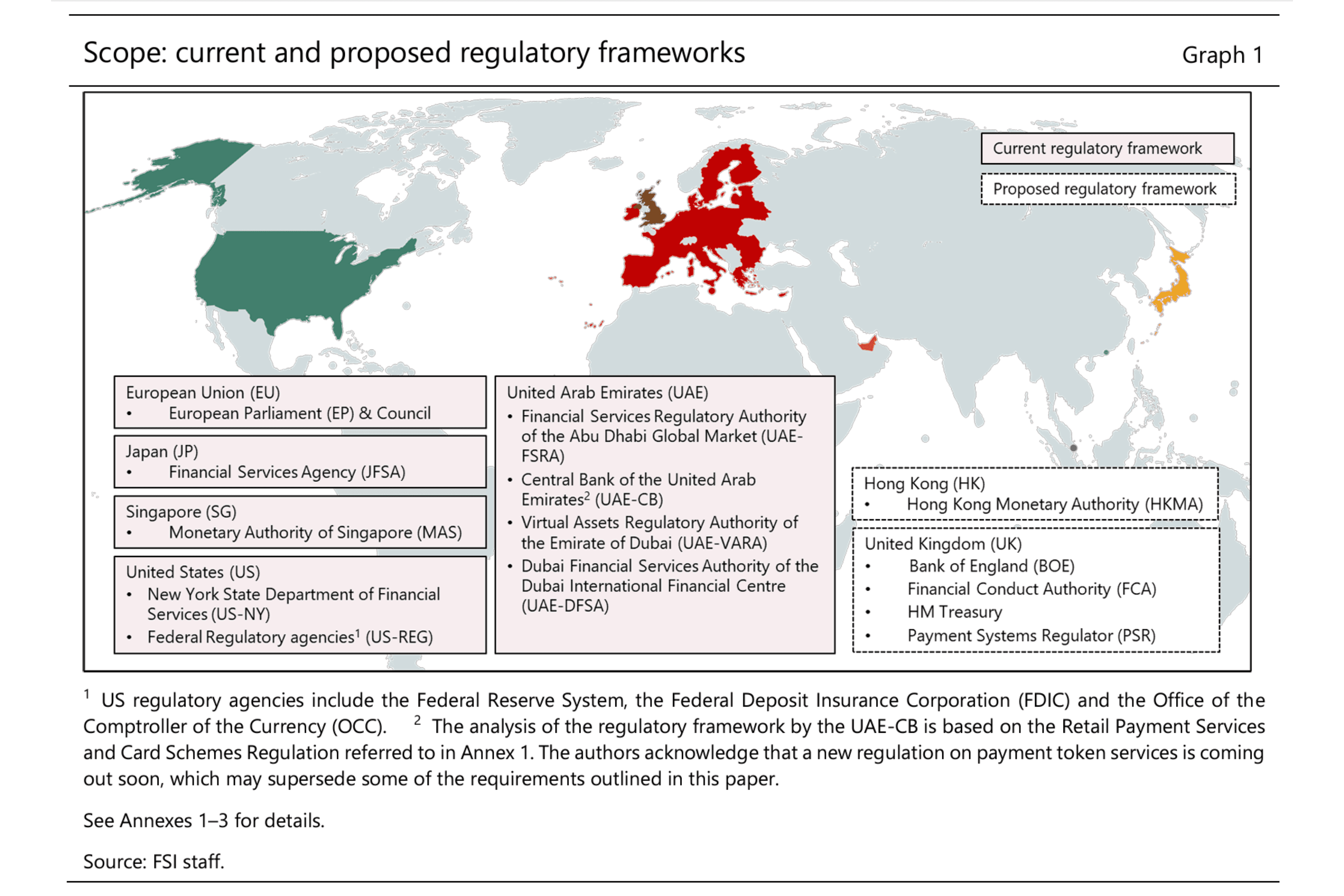

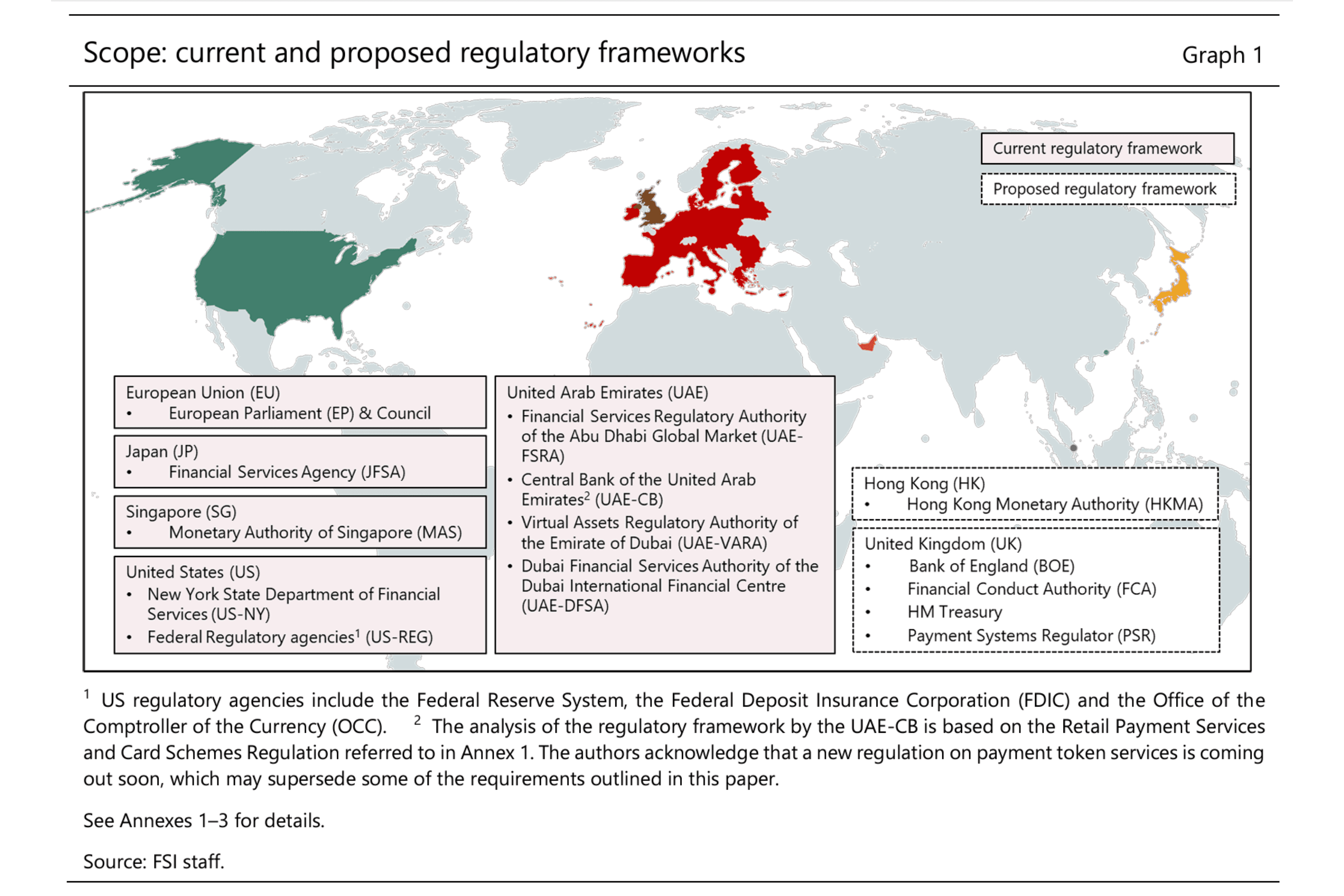

As stablecoins grow, clear regulatory frameworks are crucial. Governments worldwide are developing regulations to ensure stablecoins are secure and stable. Regulatory sandboxes have become a popular tool for governments to foster innovation while maintaining oversight.

Key examples include:

Hong Kong: The HKMA's stablecoin issuer sandbox allows financial institutions to innovate in a regulated environment.

EU: The Markets in Crypto Assets (MiCA) regulation, governs the issuance and management of stablecoins across member states.

US: The Financial Stability Oversight Council (FSOC) monitors stablecoin-related risks and recommends measures to maintain financial stability.

Japan: The Payment Services Act sets operational and reserve requirements for stablecoin issuers.

Source: Financial Stability Institute

As stablecoins grow, clear regulatory frameworks are crucial. Governments worldwide are developing regulations to ensure stablecoins are secure and stable. Regulatory sandboxes have become a popular tool for governments to foster innovation while maintaining oversight.

Key examples include:

Hong Kong: The HKMA's stablecoin issuer sandbox allows financial institutions to innovate in a regulated environment.

EU: The Markets in Crypto Assets (MiCA) regulation, governs the issuance and management of stablecoins across member states.

US: The Financial Stability Oversight Council (FSOC) monitors stablecoin-related risks and recommends measures to maintain financial stability.

Japan: The Payment Services Act sets operational and reserve requirements for stablecoin issuers.

Source: Financial Stability Institute

As stablecoins grow, clear regulatory frameworks are crucial. Governments worldwide are developing regulations to ensure stablecoins are secure and stable. Regulatory sandboxes have become a popular tool for governments to foster innovation while maintaining oversight.

Key examples include:

Hong Kong: The HKMA's stablecoin issuer sandbox allows financial institutions to innovate in a regulated environment.

EU: The Markets in Crypto Assets (MiCA) regulation, governs the issuance and management of stablecoins across member states.

US: The Financial Stability Oversight Council (FSOC) monitors stablecoin-related risks and recommends measures to maintain financial stability.

Japan: The Payment Services Act sets operational and reserve requirements for stablecoin issuers.

Source: Financial Stability Institute

Public-Private Partnerships Driving Innovation

Public-Private Partnerships Driving Innovation

Public-Private Partnerships Driving Innovation

Collaboration between regulators, financial institutions, and technology providers is crucial for stablecoin integration into the financial system. The Bank for International Settlements (BIS) and central banks worldwide are exploring the potential of stablecoins alongside central bank digital currencies (CBDCs).

“Although stablecoins are frequently viewed as competitors to central bank digital currencies (CBDCs), both forms of digital and programmable money are complementary. They have the potential to not only coexist but also enhance each other, leveraging the respective strengths of the public and private sectors,” noted economist, Christian Catalini.

Collaboration between regulators, financial institutions, and technology providers is crucial for stablecoin integration into the financial system. The Bank for International Settlements (BIS) and central banks worldwide are exploring the potential of stablecoins alongside central bank digital currencies (CBDCs).

“Although stablecoins are frequently viewed as competitors to central bank digital currencies (CBDCs), both forms of digital and programmable money are complementary. They have the potential to not only coexist but also enhance each other, leveraging the respective strengths of the public and private sectors,” noted economist, Christian Catalini.

Collaboration between regulators, financial institutions, and technology providers is crucial for stablecoin integration into the financial system. The Bank for International Settlements (BIS) and central banks worldwide are exploring the potential of stablecoins alongside central bank digital currencies (CBDCs).

“Although stablecoins are frequently viewed as competitors to central bank digital currencies (CBDCs), both forms of digital and programmable money are complementary. They have the potential to not only coexist but also enhance each other, leveraging the respective strengths of the public and private sectors,” noted economist, Christian Catalini.

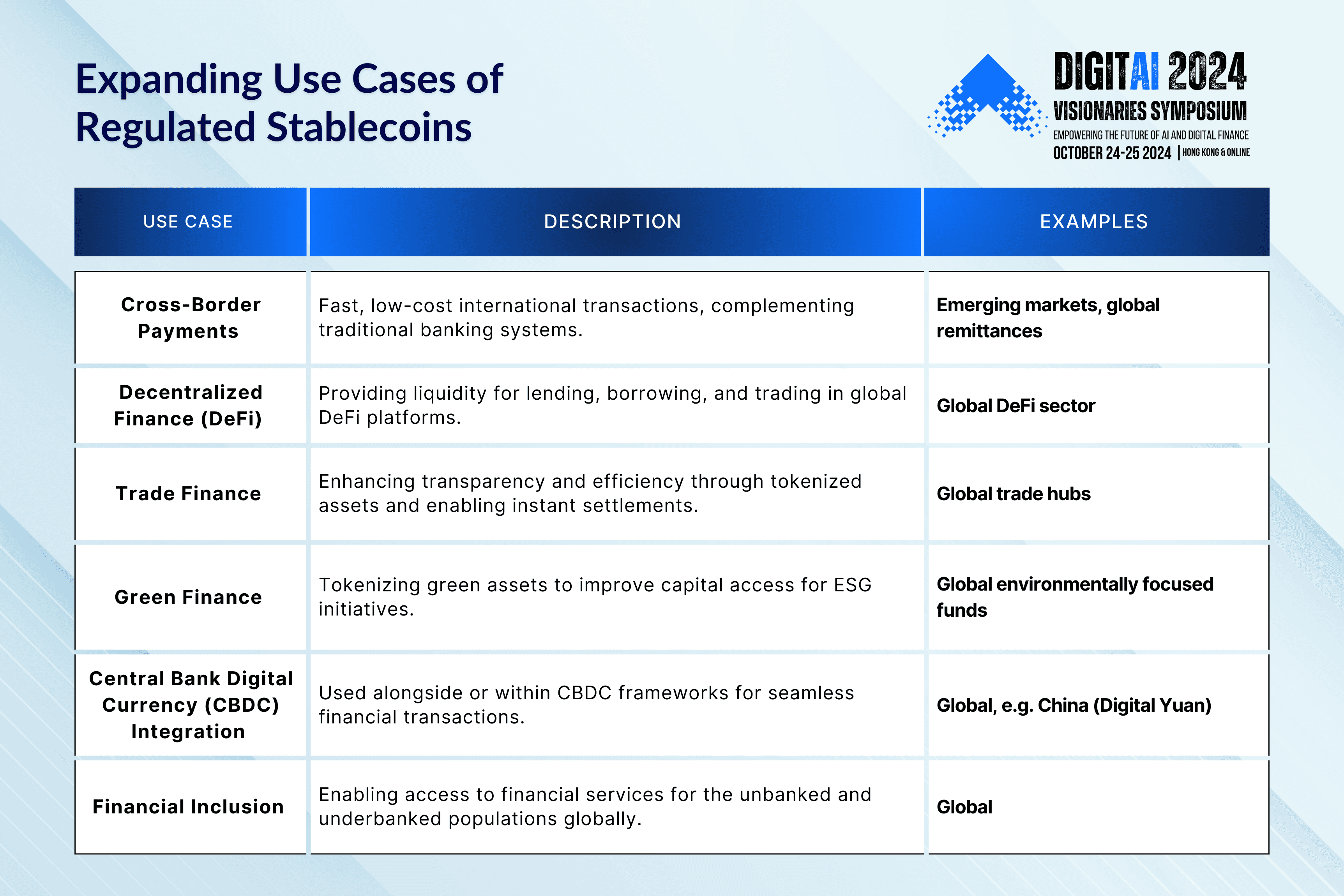

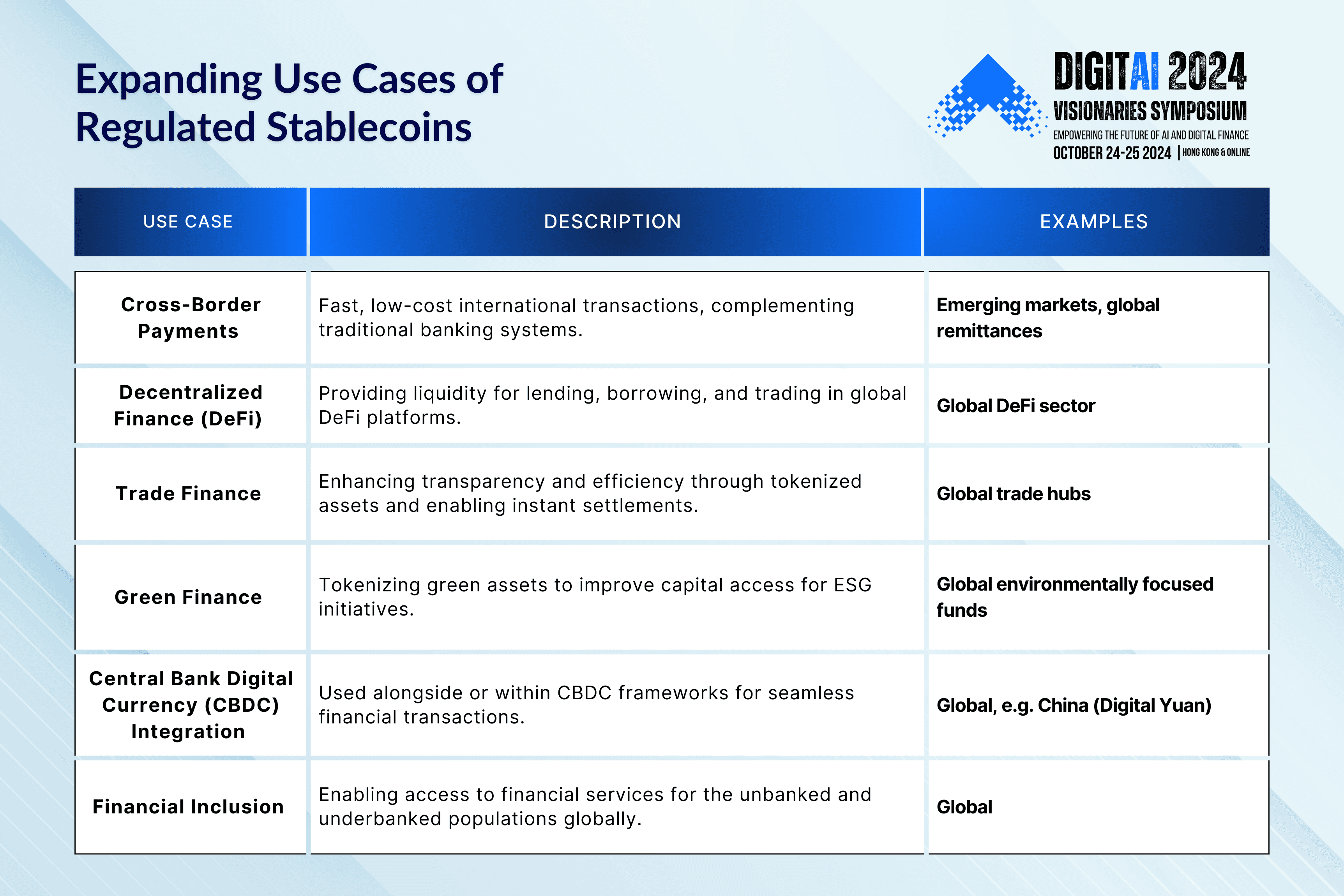

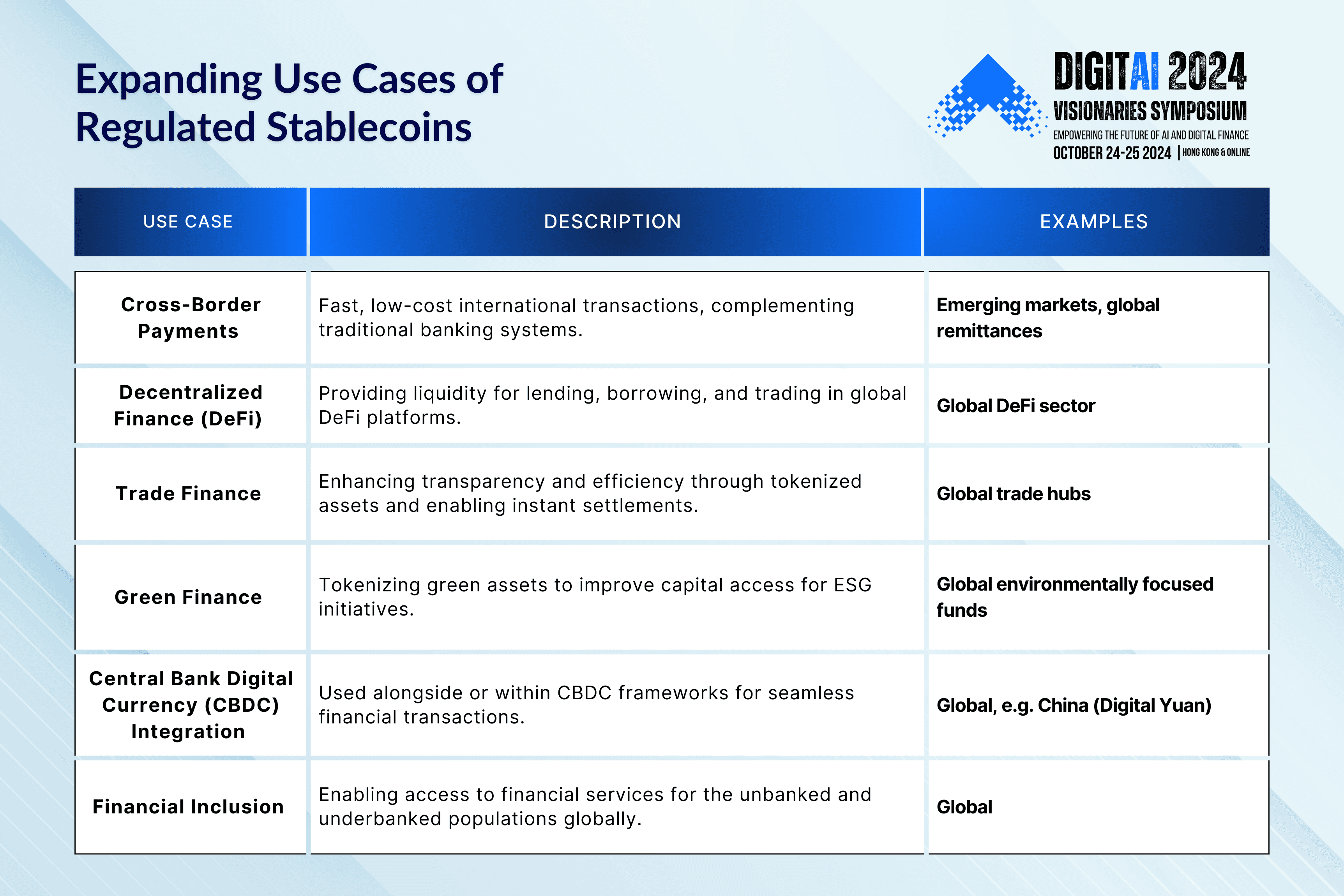

Regulated stablecoins are increasingly used in various applications, such as:

Regulated stablecoins are increasingly used in various applications, such as:

Regulated stablecoins are increasingly used in various applications, such as:

The future of stablecoins in 2025 looks very promising. With advancing regulatory clarity, technology, market adoption, and expanding public-private partnerships, regulated stablecoins is poised to reshape the future of money and global finance. The success of regulated stablecoins in 2025 will hinge on several critical factors:

Regulatory Clarity: Consistent frameworks to protect consumers, maintain financial stability and foster innovation.

Public-private partnerships: Collaborations between regulators and private sector to drive innovation and secure financial system integration.

Technological Infrastructure: Advanced blockchain platforms for scalability and security.

Market Adoption: Meeting market needs, including accessibility and low transaction costs.

Public Trust: Transparency in backing and management to build confidence.

The future of stablecoins in 2025 looks very promising. With advancing regulatory clarity, technology, market adoption, and expanding public-private partnerships, regulated stablecoins is poised to reshape the future of money and global finance. The success of regulated stablecoins in 2025 will hinge on several critical factors:

Regulatory Clarity: Consistent frameworks to protect consumers, maintain financial stability and foster innovation.

Public-private partnerships: Collaborations between regulators and private sector to drive innovation and secure financial system integration.

Technological Infrastructure: Advanced blockchain platforms for scalability and security.

Market Adoption: Meeting market needs, including accessibility and low transaction costs.

Public Trust: Transparency in backing and management to build confidence.

The future of stablecoins in 2025 looks very promising. With advancing regulatory clarity, technology, market adoption, and expanding public-private partnerships, regulated stablecoins is poised to reshape the future of money and global finance. The success of regulated stablecoins in 2025 will hinge on several critical factors:

Regulatory Clarity: Consistent frameworks to protect consumers, maintain financial stability and foster innovation.

Public-private partnerships: Collaborations between regulators and private sector to drive innovation and secure financial system integration.

Technological Infrastructure: Advanced blockchain platforms for scalability and security.

Market Adoption: Meeting market needs, including accessibility and low transaction costs.

Public Trust: Transparency in backing and management to build confidence.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong