Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

The Business Case for AI: Assessing the Return on AI (RoAI)

The Business Case for AI: Assessing the Return on AI (RoAI)

The Business Case for AI: Assessing the Return on AI (RoAI)

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Sep 20, 2024

Sep 20, 2024

Enterprise AI applications have potential to generate measurable business value. However, tangible returns are difficult to quantify.

Enhancing operational efficiency, and industries like finance, healthcare, and retail, have been earmarked as the most promising sectors to be boosted by AI.

Hear from industry leaders at the Digital Visionaries Symposium 2024. Don’t miss this panel discussion – “The Business Case for AI: Assessing the Value and ROI of AI and Digital Strategies” – on October 24, 2024. Participate in person or online for actionable insights into AI and digital finance.

Enterprise AI applications have potential to generate measurable business value. However, tangible returns are difficult to quantify.

Enhancing operational efficiency, and industries like finance, healthcare, and retail, have been earmarked as the most promising sectors to be boosted by AI.

Hear from industry leaders at the Digital Visionaries Symposium 2024. Don’t miss this panel discussion – “The Business Case for AI: Assessing the Value and ROI of AI and Digital Strategies” – on October 24, 2024. Participate in person or online for actionable insights into AI and digital finance.

Enterprise AI applications have potential to generate measurable business value. However, tangible returns are difficult to quantify.

Enhancing operational efficiency, and industries like finance, healthcare, and retail, have been earmarked as the most promising sectors to be boosted by AI.

Hear from industry leaders at the Digital Visionaries Symposium 2024. Don’t miss this panel discussion – “The Business Case for AI: Assessing the Value and ROI of AI and Digital Strategies” – on October 24, 2024. Participate in person or online for actionable insights into AI and digital finance.

In today’s rapidly evolving digital landscape, artificial intelligence (AI) has emerged as a critical tool for businesses seeking to optimize operations, and drive growth. However, some companies are struggling to realize the return on AI, potentially leading to a 30% abandonment rate for generative AI projects by 2025.

Understanding the quantifiable impact of AI applications on business value is crucial. This insight examines how AI applications contribute to measurable outcomes and assess the return on AI (ROAI) across industries.

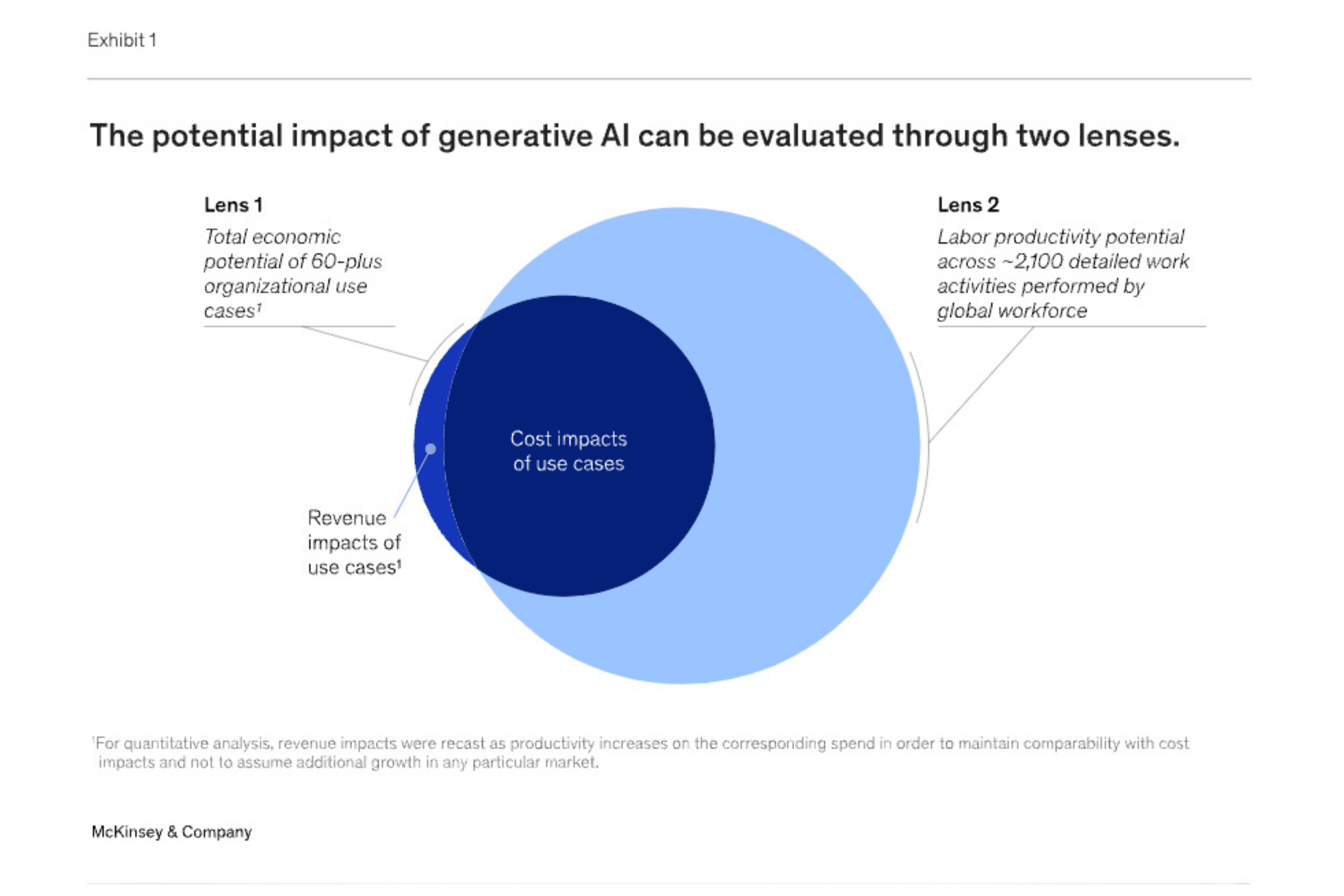

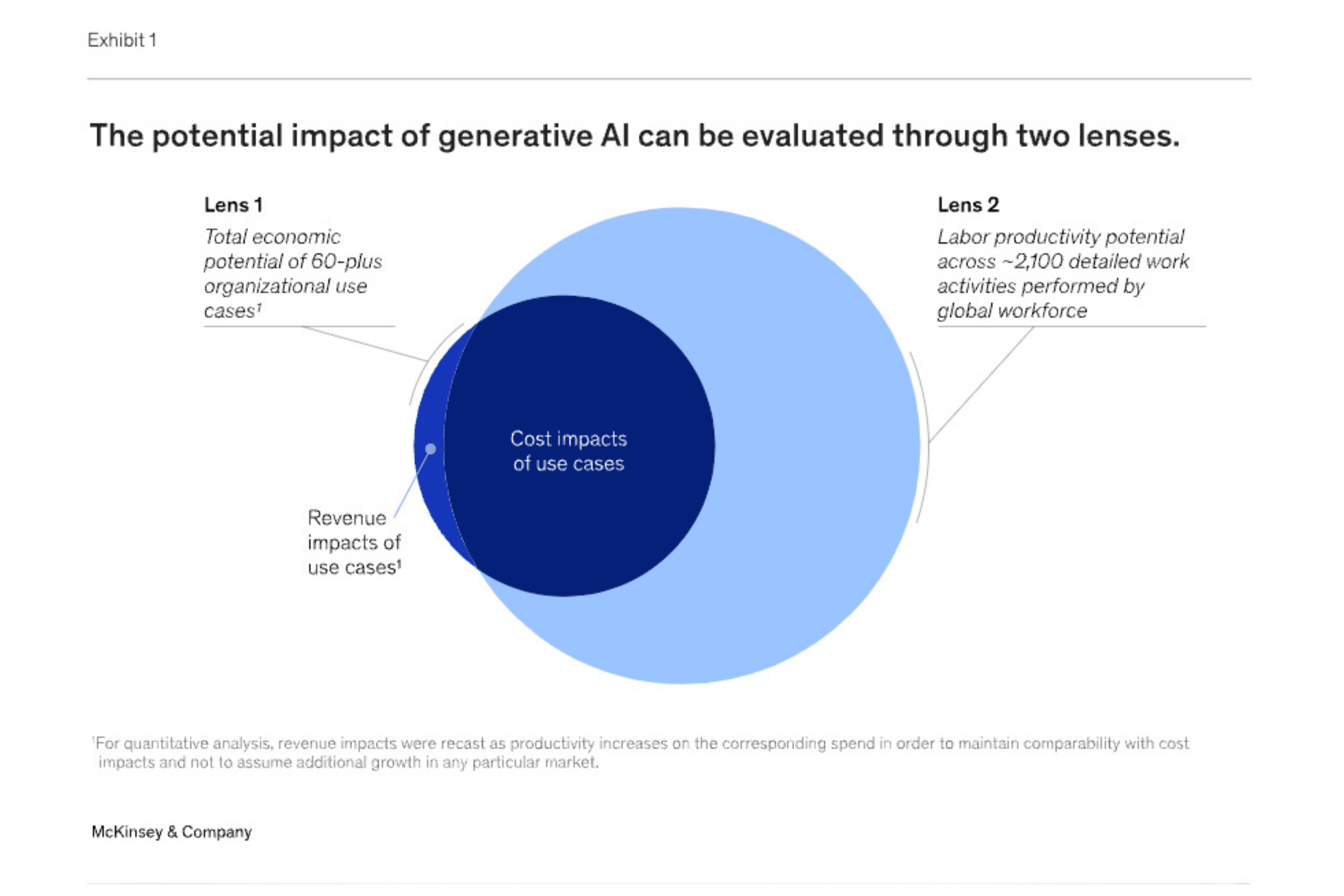

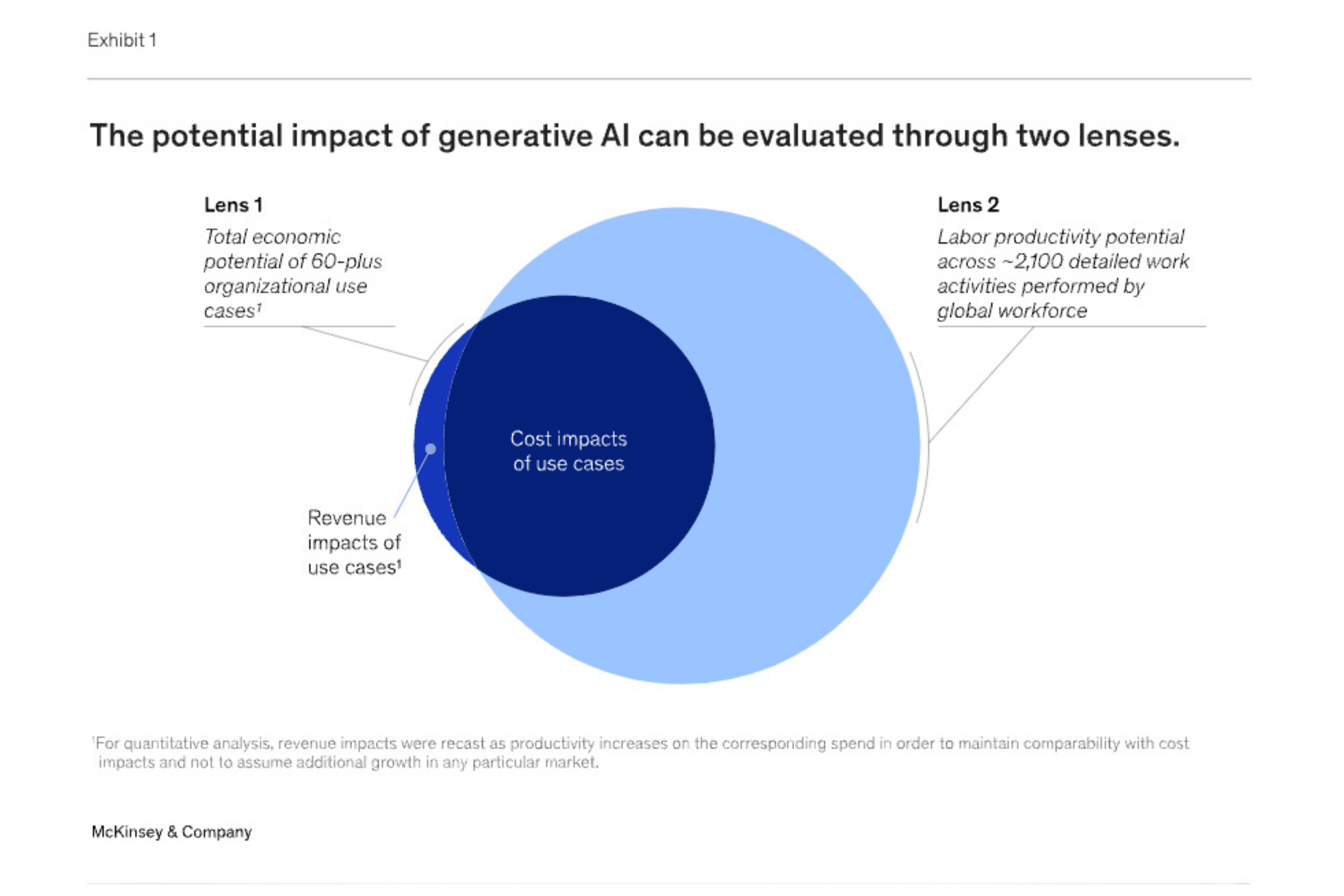

Source: McKinsey & Company

In today’s rapidly evolving digital landscape, artificial intelligence (AI) has emerged as a critical tool for businesses seeking to optimize operations, and drive growth. However, some companies are struggling to realize the return on AI, potentially leading to a 30% abandonment rate for generative AI projects by 2025.

Understanding the quantifiable impact of AI applications on business value is crucial. This insight examines how AI applications contribute to measurable outcomes and assess the return on AI (ROAI) across industries.

Source: McKinsey & Company

In today’s rapidly evolving digital landscape, artificial intelligence (AI) has emerged as a critical tool for businesses seeking to optimize operations, and drive growth. However, some companies are struggling to realize the return on AI, potentially leading to a 30% abandonment rate for generative AI projects by 2025.

Understanding the quantifiable impact of AI applications on business value is crucial. This insight examines how AI applications contribute to measurable outcomes and assess the return on AI (ROAI) across industries.

Source: McKinsey & Company

AI could contribute $15.7 Trillion to global economy

AI could contribute $15.7 Trillion to global economy

AI could contribute $15.7 Trillion to global economy

AI’s ability to process vast amounts of data, identify patterns, and make predictive decisions faster than humans enables businesses to optimize operations in ways previously thought impossible.

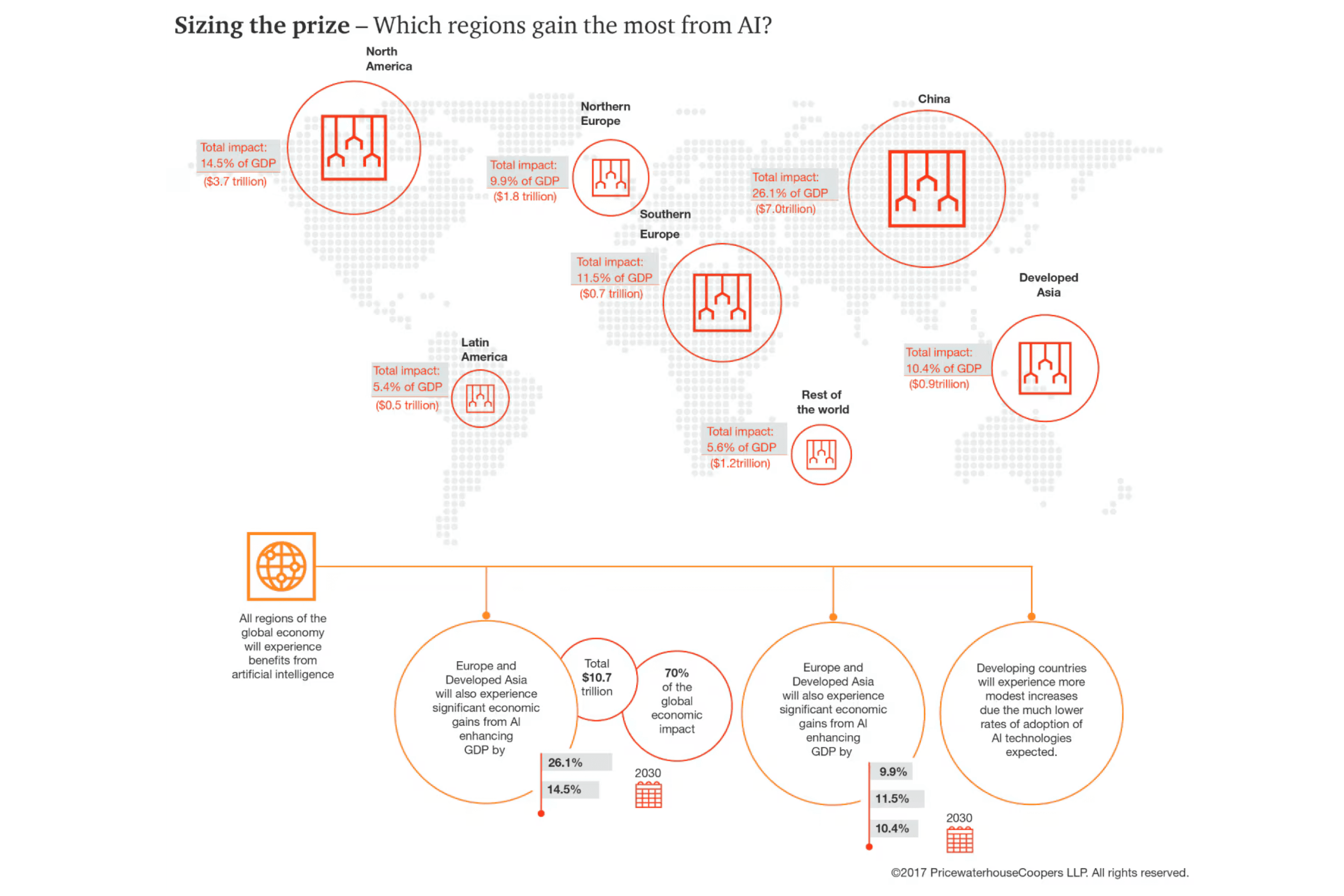

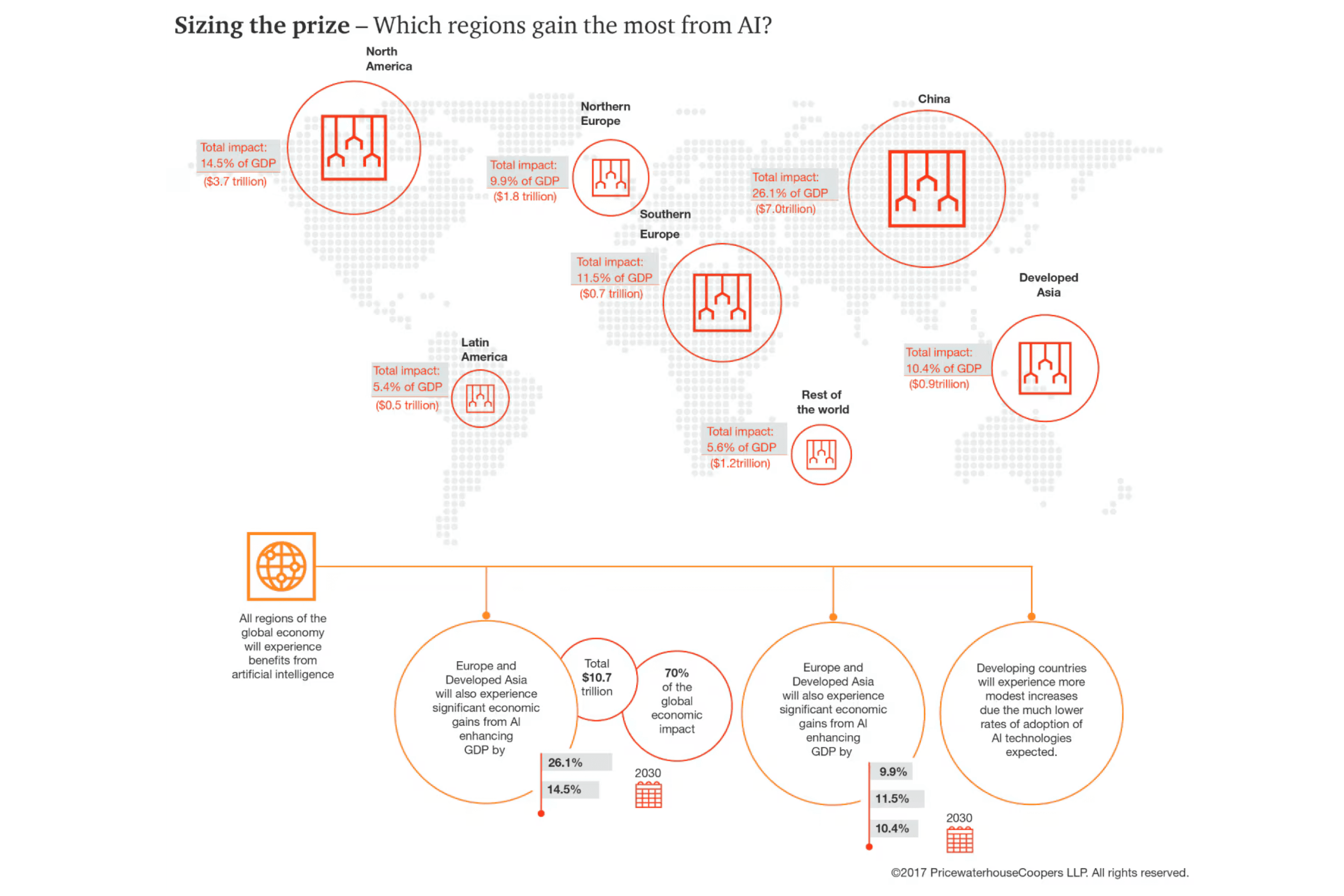

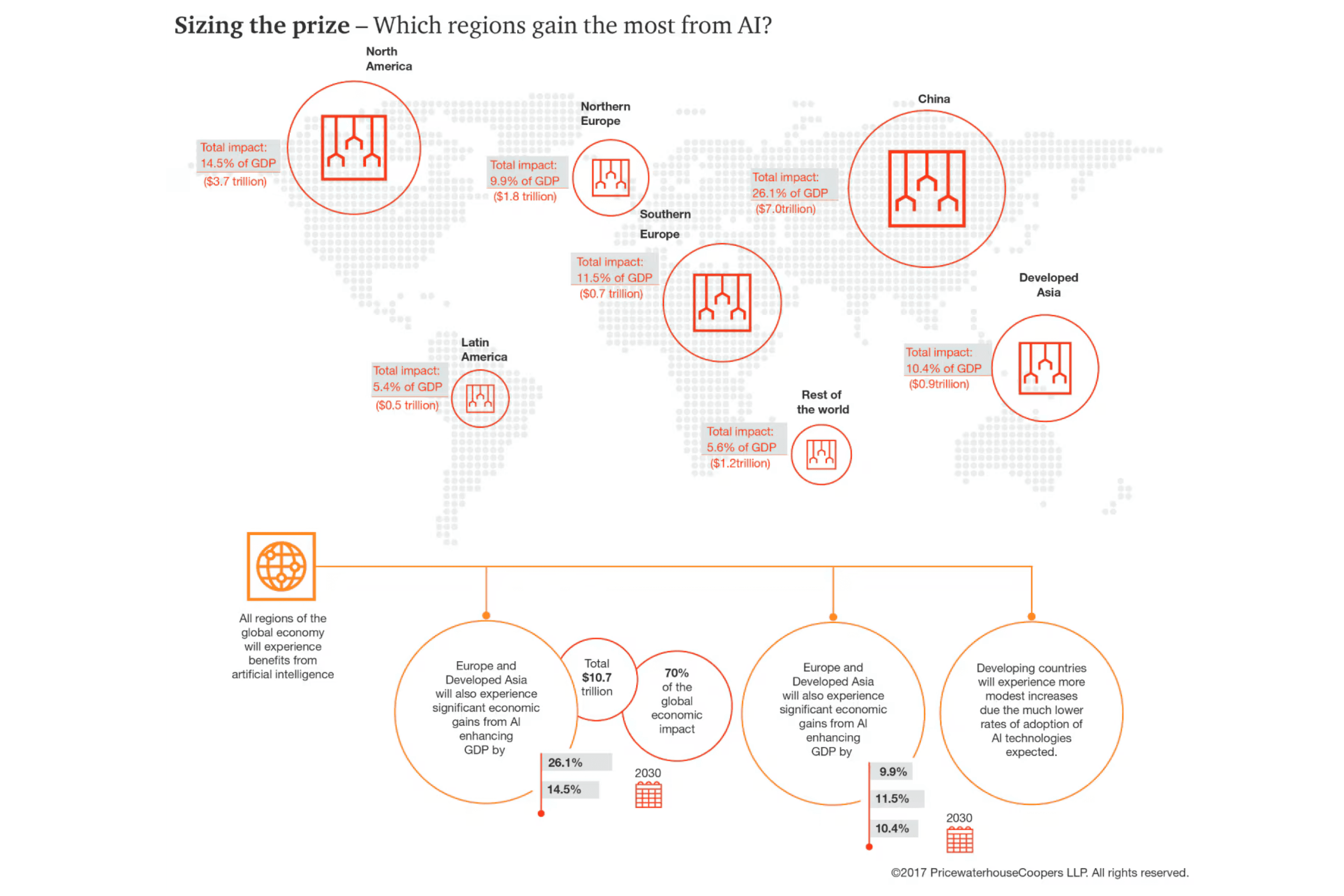

According to a PwC report, AI could contribute up to $15.7 trillion to the global economy by 2030, with nearly half of these gains coming from productivity improvements.

McKinsey forecasts that GenAI could contribute between $2.6 trillion and $4.4 trillion in global economic value annually. This is on top of the estimated $11 trillion to $17.7 trillion value that traditional AI and analytics might generate. In total, AI (including GenAI) could unlock $6.1 trillion to $7.9 trillion yearly.

Industries like banking, high tech, and life sciences stand to experience the greatest impact on their revenues from generative AI. In banking alone, fully adopting AI use cases could generate an additional $200 billion to $340 billion annually.

Similarly, the retail and consumer packaged goods sectors could see substantial gains, with potential increases ranging from $400 billion to $660 billion per year.

…and AI spend could ratchet up to $200 Billion or more by 2025

A 2024 industry outlook by Deloitte forecasts global AI-related investments to hit $200 billion by 2025, driven by increased spending on AI, cybersecurity, and cloud technologies. AI, particularly generative AI, is expected to drive significant efficiency gains and new business models in 2024

Statista projects the global AI market to grow at a CAGR of 28.46%, reaching $826.7 billion by 2030. Key drivers include advancements in generative AI, automation, and personalized AI applications across various industries.

AI could contribute up to $15.7 trillion to the global economy by 2030.

Source: PwC

AI’s ability to process vast amounts of data, identify patterns, and make predictive decisions faster than humans enables businesses to optimize operations in ways previously thought impossible.

According to a PwC report, AI could contribute up to $15.7 trillion to the global economy by 2030, with nearly half of these gains coming from productivity improvements.

McKinsey forecasts that GenAI could contribute between $2.6 trillion and $4.4 trillion in global economic value annually. This is on top of the estimated $11 trillion to $17.7 trillion value that traditional AI and analytics might generate. In total, AI (including GenAI) could unlock $6.1 trillion to $7.9 trillion yearly.

Industries like banking, high tech, and life sciences stand to experience the greatest impact on their revenues from generative AI. In banking alone, fully adopting AI use cases could generate an additional $200 billion to $340 billion annually.

Similarly, the retail and consumer packaged goods sectors could see substantial gains, with potential increases ranging from $400 billion to $660 billion per year.

…and AI spend could ratchet up to $200 Billion or more by 2025

A 2024 industry outlook by Deloitte forecasts global AI-related investments to hit $200 billion by 2025, driven by increased spending on AI, cybersecurity, and cloud technologies. AI, particularly generative AI, is expected to drive significant efficiency gains and new business models in 2024

Statista projects the global AI market to grow at a CAGR of 28.46%, reaching $826.7 billion by 2030. Key drivers include advancements in generative AI, automation, and personalized AI applications across various industries.

AI could contribute up to $15.7 trillion to the global economy by 2030.

Source: PwC

AI’s ability to process vast amounts of data, identify patterns, and make predictive decisions faster than humans enables businesses to optimize operations in ways previously thought impossible.

According to a PwC report, AI could contribute up to $15.7 trillion to the global economy by 2030, with nearly half of these gains coming from productivity improvements.

McKinsey forecasts that GenAI could contribute between $2.6 trillion and $4.4 trillion in global economic value annually. This is on top of the estimated $11 trillion to $17.7 trillion value that traditional AI and analytics might generate. In total, AI (including GenAI) could unlock $6.1 trillion to $7.9 trillion yearly.

Industries like banking, high tech, and life sciences stand to experience the greatest impact on their revenues from generative AI. In banking alone, fully adopting AI use cases could generate an additional $200 billion to $340 billion annually.

Similarly, the retail and consumer packaged goods sectors could see substantial gains, with potential increases ranging from $400 billion to $660 billion per year.

…and AI spend could ratchet up to $200 Billion or more by 2025

A 2024 industry outlook by Deloitte forecasts global AI-related investments to hit $200 billion by 2025, driven by increased spending on AI, cybersecurity, and cloud technologies. AI, particularly generative AI, is expected to drive significant efficiency gains and new business models in 2024

Statista projects the global AI market to grow at a CAGR of 28.46%, reaching $826.7 billion by 2030. Key drivers include advancements in generative AI, automation, and personalized AI applications across various industries.

AI could contribute up to $15.7 trillion to the global economy by 2030.

Source: PwC

Key benefits of Financial and Enterprise AI applications

Key benefits of Financial and Enterprise AI applications

Key benefits of Financial and Enterprise AI applications

Cost Reduction and Operational Efficiency:

AI-driven automation allows businesses to streamline labor-intensive processes and reduce the need for human intervention. For example, in manufacturing, AI-powered robotics and automation systems have reduced production line downtime by up to 40%, minimizing errors and increasing output. AI is also being used in predictive maintenance to forecast equipment failure before it happens, preventing costly breakdowns.Enhanced Investment Decision-Making:

In sectors like finance, AI is used to analyze market trends, improve risk assessments, and optimize investment strategies, leading to better financial outcomes. For instance, Goldman Sachs uses AI algorithms to analyze vast data sets in real-time, providing traders with insights that were previously unattainable, helping them make better decisions on market positions and risk management.Improved Customer Experiences and Personalization:

In customer-facing sectors, AI enables businesses to deliver personalized experiences at scale. Retailers like Amazon and Netflix utilize AI to recommend products and content based on individual consumer behavior, increasing user engagement and boosting sales. AI’s ability to process user data in real-time allows businesses to deliver hyper-personalized interactions, driving customer loyalty and lifetime value. According to Salesforce, 62% of consumers expect companies to use AI to anticipate their needs, and businesses that effectively deploy AI in customer service can see increases in customer retention by as much as 25%.AI-driven Revenue Growth Through New Products and Services: 86% of respondents reported estimated revenue gains of more than 6% due to GenAI implementations (research by Google Cloud).

For example, in the automotive industry, companies like Tesla are integrating AI into their vehicles for autonomous driving, unlocking a new market for self-driving technologies. In healthcare, GenAI is being used to develop personalized treatment plans, predictive diagnostics, and virtual health assistants, leading to improved patient outcomes and expanded service offerings for providers. McKinsey estimates that AI could potentially generate up to $1.5 trillion through 2027 in the healthcare industry alone.

Cost Reduction and Operational Efficiency:

AI-driven automation allows businesses to streamline labor-intensive processes and reduce the need for human intervention. For example, in manufacturing, AI-powered robotics and automation systems have reduced production line downtime by up to 40%, minimizing errors and increasing output. AI is also being used in predictive maintenance to forecast equipment failure before it happens, preventing costly breakdowns.Enhanced Investment Decision-Making:

In sectors like finance, AI is used to analyze market trends, improve risk assessments, and optimize investment strategies, leading to better financial outcomes. For instance, Goldman Sachs uses AI algorithms to analyze vast data sets in real-time, providing traders with insights that were previously unattainable, helping them make better decisions on market positions and risk management.Improved Customer Experiences and Personalization:

In customer-facing sectors, AI enables businesses to deliver personalized experiences at scale. Retailers like Amazon and Netflix utilize AI to recommend products and content based on individual consumer behavior, increasing user engagement and boosting sales. AI’s ability to process user data in real-time allows businesses to deliver hyper-personalized interactions, driving customer loyalty and lifetime value. According to Salesforce, 62% of consumers expect companies to use AI to anticipate their needs, and businesses that effectively deploy AI in customer service can see increases in customer retention by as much as 25%.AI-driven Revenue Growth Through New Products and Services: 86% of respondents reported estimated revenue gains of more than 6% due to GenAI implementations (research by Google Cloud).

For example, in the automotive industry, companies like Tesla are integrating AI into their vehicles for autonomous driving, unlocking a new market for self-driving technologies. In healthcare, GenAI is being used to develop personalized treatment plans, predictive diagnostics, and virtual health assistants, leading to improved patient outcomes and expanded service offerings for providers. McKinsey estimates that AI could potentially generate up to $1.5 trillion through 2027 in the healthcare industry alone.

Cost Reduction and Operational Efficiency:

AI-driven automation allows businesses to streamline labor-intensive processes and reduce the need for human intervention. For example, in manufacturing, AI-powered robotics and automation systems have reduced production line downtime by up to 40%, minimizing errors and increasing output. AI is also being used in predictive maintenance to forecast equipment failure before it happens, preventing costly breakdowns.Enhanced Investment Decision-Making:

In sectors like finance, AI is used to analyze market trends, improve risk assessments, and optimize investment strategies, leading to better financial outcomes. For instance, Goldman Sachs uses AI algorithms to analyze vast data sets in real-time, providing traders with insights that were previously unattainable, helping them make better decisions on market positions and risk management.Improved Customer Experiences and Personalization:

In customer-facing sectors, AI enables businesses to deliver personalized experiences at scale. Retailers like Amazon and Netflix utilize AI to recommend products and content based on individual consumer behavior, increasing user engagement and boosting sales. AI’s ability to process user data in real-time allows businesses to deliver hyper-personalized interactions, driving customer loyalty and lifetime value. According to Salesforce, 62% of consumers expect companies to use AI to anticipate their needs, and businesses that effectively deploy AI in customer service can see increases in customer retention by as much as 25%.AI-driven Revenue Growth Through New Products and Services: 86% of respondents reported estimated revenue gains of more than 6% due to GenAI implementations (research by Google Cloud).

For example, in the automotive industry, companies like Tesla are integrating AI into their vehicles for autonomous driving, unlocking a new market for self-driving technologies. In healthcare, GenAI is being used to develop personalized treatment plans, predictive diagnostics, and virtual health assistants, leading to improved patient outcomes and expanded service offerings for providers. McKinsey estimates that AI could potentially generate up to $1.5 trillion through 2027 in the healthcare industry alone.

Maximizing The Long-Term Value of AI: Key Metrics for ROI Assessment

Maximizing The Long-Term Value of AI: Key Metrics for ROI Assessment

Maximizing The Long-Term Value of AI: Key Metrics for ROI Assessment

Given the significant upfront costs associated with AI, calculating its return on investment (ROI) is a top priority for institutions. The return on AI initiatives often materialize in multiple forms, including direct cost savings, productivity improvements, and revenue growth. However, unlike traditional IT investments, AI’s value can be more nuanced, often requiring a combination of financial metrics and non-financial benefits to evaluate its full impact.

Below are key metrics businesses can use to assess AI's ROI:

Comprehensive ROI Measurement

Challenge: While AI offers significant opportunities for value creation, businesses must navigate several challenges to fully realize their ROI.

Solution: Companies should adopt a holistic measurement framework, tracking both direct financial gains and secondary impacts such as brand loyalty or faster time-to-market.

Cost Efficiency and Phased Implementation

Challenge: The upfront costs of AI—such as technology acquisition, data integration, and ongoing system maintenance—can delay the realization of returns.

Solution: To mitigate this, companies should adopt phased AI implementation strategies, starting with pilot projects that offer quick wins and clear financial benefits. This approach allows businesses to demonstrate early ROI, gain executive buy-in, and secure additional resources for further AI scaling.

Strategic Alignment with Long-Term Goals

Challenge: Ensuring AI aligns with long-term business goals is also critical for maximizing value.

Solution: AI should be integrated into broader digital transformation strategies, focusing on areas where it can drive scalable and sustainable results. For example, AI applications in predictive maintenance or customer analytics not only provide immediate operational improvements but also position the company for future innovation and growth.

Given the significant upfront costs associated with AI, calculating its return on investment (ROI) is a top priority for institutions. The return on AI initiatives often materialize in multiple forms, including direct cost savings, productivity improvements, and revenue growth. However, unlike traditional IT investments, AI’s value can be more nuanced, often requiring a combination of financial metrics and non-financial benefits to evaluate its full impact.

Below are key metrics businesses can use to assess AI's ROI:

Comprehensive ROI Measurement

Challenge: While AI offers significant opportunities for value creation, businesses must navigate several challenges to fully realize their ROI.

Solution: Companies should adopt a holistic measurement framework, tracking both direct financial gains and secondary impacts such as brand loyalty or faster time-to-market.

Cost Efficiency and Phased Implementation

Challenge: The upfront costs of AI—such as technology acquisition, data integration, and ongoing system maintenance—can delay the realization of returns.

Solution: To mitigate this, companies should adopt phased AI implementation strategies, starting with pilot projects that offer quick wins and clear financial benefits. This approach allows businesses to demonstrate early ROI, gain executive buy-in, and secure additional resources for further AI scaling.

Strategic Alignment with Long-Term Goals

Challenge: Ensuring AI aligns with long-term business goals is also critical for maximizing value.

Solution: AI should be integrated into broader digital transformation strategies, focusing on areas where it can drive scalable and sustainable results. For example, AI applications in predictive maintenance or customer analytics not only provide immediate operational improvements but also position the company for future innovation and growth.

Given the significant upfront costs associated with AI, calculating its return on investment (ROI) is a top priority for institutions. The return on AI initiatives often materialize in multiple forms, including direct cost savings, productivity improvements, and revenue growth. However, unlike traditional IT investments, AI’s value can be more nuanced, often requiring a combination of financial metrics and non-financial benefits to evaluate its full impact.

Below are key metrics businesses can use to assess AI's ROI:

Comprehensive ROI Measurement

Challenge: While AI offers significant opportunities for value creation, businesses must navigate several challenges to fully realize their ROI.

Solution: Companies should adopt a holistic measurement framework, tracking both direct financial gains and secondary impacts such as brand loyalty or faster time-to-market.

Cost Efficiency and Phased Implementation

Challenge: The upfront costs of AI—such as technology acquisition, data integration, and ongoing system maintenance—can delay the realization of returns.

Solution: To mitigate this, companies should adopt phased AI implementation strategies, starting with pilot projects that offer quick wins and clear financial benefits. This approach allows businesses to demonstrate early ROI, gain executive buy-in, and secure additional resources for further AI scaling.

Strategic Alignment with Long-Term Goals

Challenge: Ensuring AI aligns with long-term business goals is also critical for maximizing value.

Solution: AI should be integrated into broader digital transformation strategies, focusing on areas where it can drive scalable and sustainable results. For example, AI applications in predictive maintenance or customer analytics not only provide immediate operational improvements but also position the company for future innovation and growth.

To assess the full RoAI, businesses must take a long-term view, recognizing that some of the most significant returns may come from indirect or intangible benefits, such as increased innovation capacity, improved customer loyalty, and enhanced competitive advantage.

To fully capitalize on AI’s potential, companies should follow three actionable strategies:

Strategic Integration: Align AI initiatives with overarching business goals by identifying use cases that directly support growth objectives, such as increasing customer lifetime value or improving operational efficiency. Ensure AI solutions are embedded across business functions rather than siloed in IT or innovation labs.

Scalability and Flexibility: Build AI solutions with scalability in mind, allowing for the gradual integration of more advanced capabilities over time. This approach helps businesses maximize their AI investment by expanding its application to new areas as they mature.

Continuous Evaluation and Adaptation: As AI technologies and business needs evolve, organizations should regularly assess their AI strategies. This includes refining performance metrics, adjusting goals based on market conditions, and ensuring that AI remains aligned with the company’s long-term vision. By continuously monitoring AI’s impact and making iterative improvements, businesses can enhance their ROI and remain competitive in the digital landscape.

To assess the full RoAI, businesses must take a long-term view, recognizing that some of the most significant returns may come from indirect or intangible benefits, such as increased innovation capacity, improved customer loyalty, and enhanced competitive advantage.

To fully capitalize on AI’s potential, companies should follow three actionable strategies:

Strategic Integration: Align AI initiatives with overarching business goals by identifying use cases that directly support growth objectives, such as increasing customer lifetime value or improving operational efficiency. Ensure AI solutions are embedded across business functions rather than siloed in IT or innovation labs.

Scalability and Flexibility: Build AI solutions with scalability in mind, allowing for the gradual integration of more advanced capabilities over time. This approach helps businesses maximize their AI investment by expanding its application to new areas as they mature.

Continuous Evaluation and Adaptation: As AI technologies and business needs evolve, organizations should regularly assess their AI strategies. This includes refining performance metrics, adjusting goals based on market conditions, and ensuring that AI remains aligned with the company’s long-term vision. By continuously monitoring AI’s impact and making iterative improvements, businesses can enhance their ROI and remain competitive in the digital landscape.

To assess the full RoAI, businesses must take a long-term view, recognizing that some of the most significant returns may come from indirect or intangible benefits, such as increased innovation capacity, improved customer loyalty, and enhanced competitive advantage.

To fully capitalize on AI’s potential, companies should follow three actionable strategies:

Strategic Integration: Align AI initiatives with overarching business goals by identifying use cases that directly support growth objectives, such as increasing customer lifetime value or improving operational efficiency. Ensure AI solutions are embedded across business functions rather than siloed in IT or innovation labs.

Scalability and Flexibility: Build AI solutions with scalability in mind, allowing for the gradual integration of more advanced capabilities over time. This approach helps businesses maximize their AI investment by expanding its application to new areas as they mature.

Continuous Evaluation and Adaptation: As AI technologies and business needs evolve, organizations should regularly assess their AI strategies. This includes refining performance metrics, adjusting goals based on market conditions, and ensuring that AI remains aligned with the company’s long-term vision. By continuously monitoring AI’s impact and making iterative improvements, businesses can enhance their ROI and remain competitive in the digital landscape.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong