Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

Key Success Drivers in Real World Asset Tokenization in 2025

Key Success Drivers in Real World Asset Tokenization in 2025

Key Success Drivers in Real World Asset Tokenization in 2025

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Sep 13, 2024

Sep 13, 2024

The RWA tokenization market is expected to reach $2-4 trillion by 2030, with real estate, private equity, and commodities driving growth.

To fully realize this massive opportunity, dialogue and collaboration among major stakeholders - financial institutions, governments and regulators – are critical.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how RWA tokenization are reshaping the global financial landscape. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

The RWA tokenization market is expected to reach $2-4 trillion by 2030, with real estate, private equity, and commodities driving growth.

To fully realize this massive opportunity, dialogue and collaboration among major stakeholders - financial institutions, governments and regulators – are critical.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how RWA tokenization are reshaping the global financial landscape. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

The RWA tokenization market is expected to reach $2-4 trillion by 2030, with real estate, private equity, and commodities driving growth.

To fully realize this massive opportunity, dialogue and collaboration among major stakeholders - financial institutions, governments and regulators – are critical.

Join industry leaders at the Digital Visionaries Symposium 2024 for insights on how RWA tokenization are reshaping the global financial landscape. Don’t miss this panel discussion—participate in person or online for actionable insights into AI and digital finance.

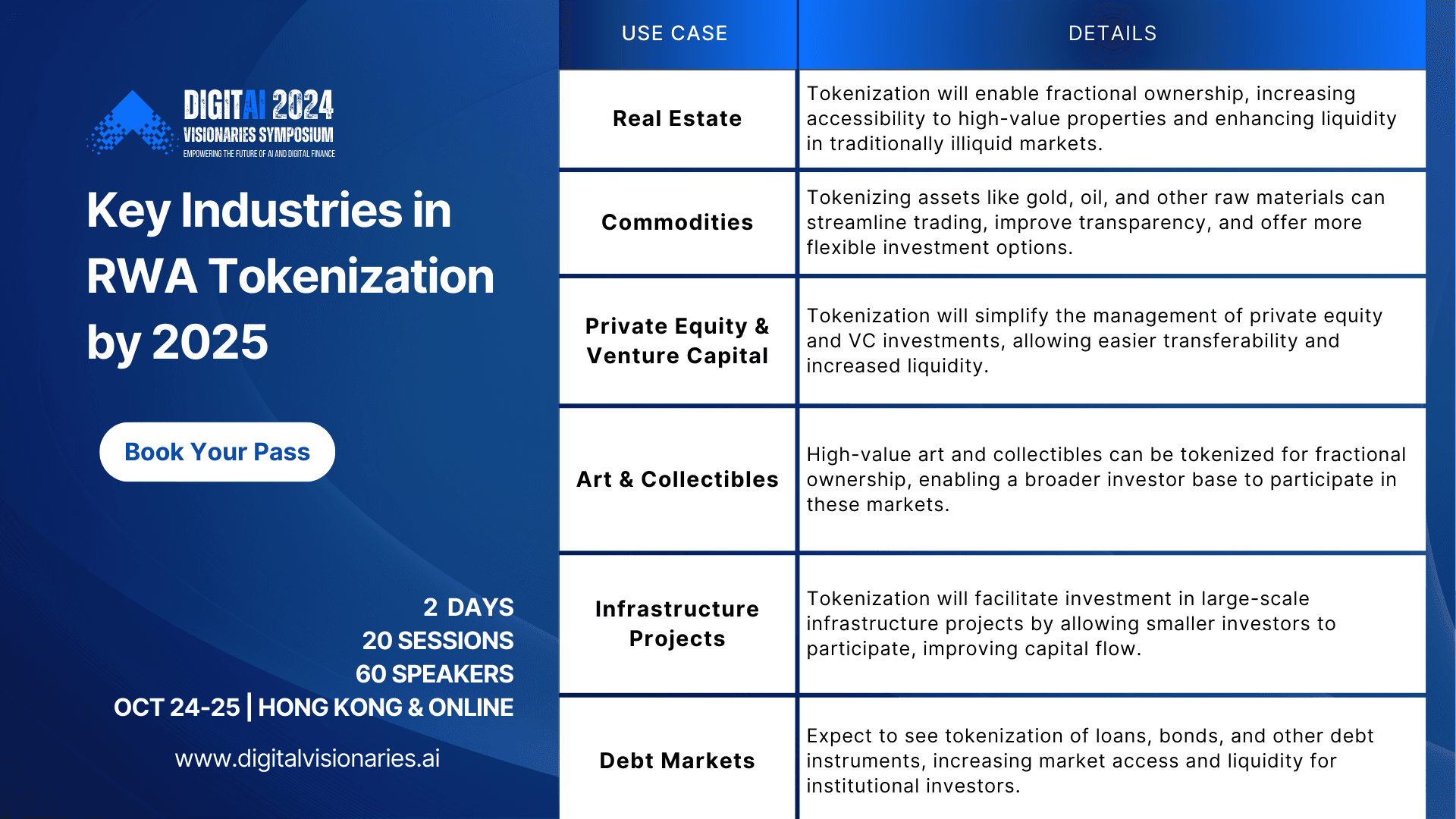

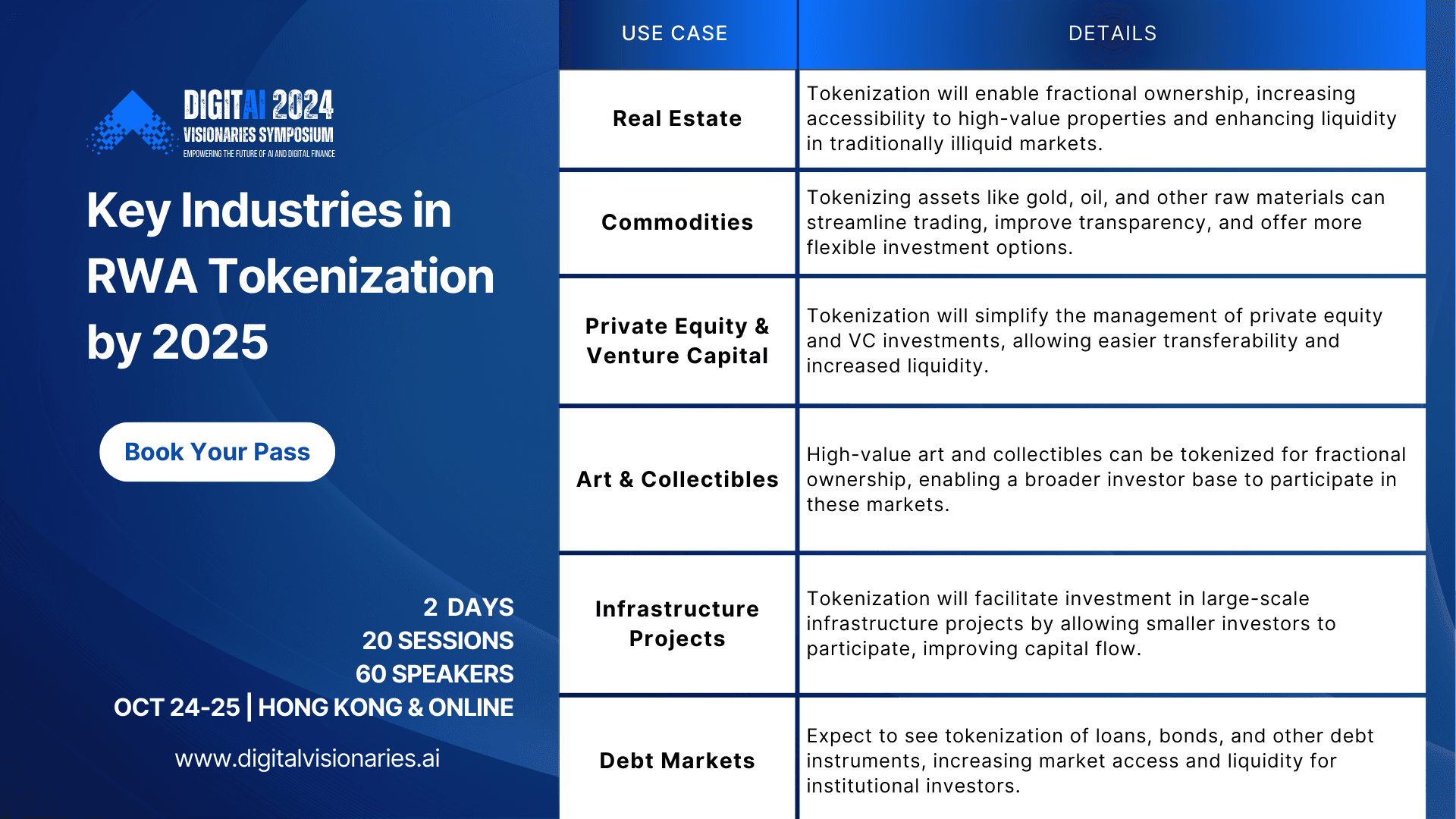

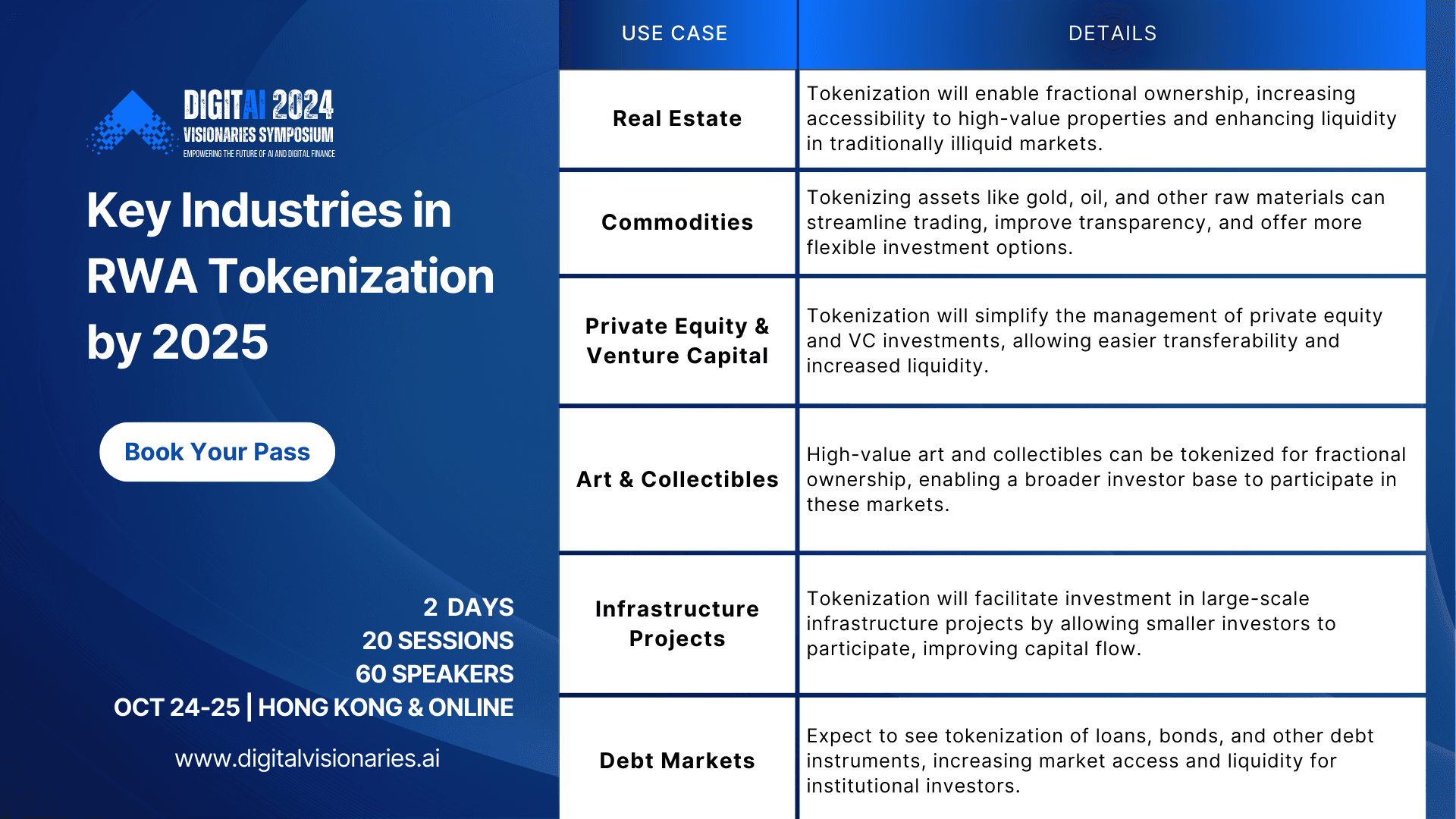

Tokenizing real-world assets (RWA) is rapidly reshaping finance, enabling the digitization and blockchain-based trading of traditional assets. As we head into 2025, tokenization is poised to continue to streamline how assets are traded, owned, and managed, by converting physical into digital assets. We explore the key trends shaping the future of RWA tokenization below, with actionable insights for enterprise leaders.

Tokenizing real-world assets (RWA) is rapidly reshaping finance, enabling the digitization and blockchain-based trading of traditional assets. As we head into 2025, tokenization is poised to continue to streamline how assets are traded, owned, and managed, by converting physical into digital assets. We explore the key trends shaping the future of RWA tokenization below, with actionable insights for enterprise leaders.

Tokenizing real-world assets (RWA) is rapidly reshaping finance, enabling the digitization and blockchain-based trading of traditional assets. As we head into 2025, tokenization is poised to continue to streamline how assets are traded, owned, and managed, by converting physical into digital assets. We explore the key trends shaping the future of RWA tokenization below, with actionable insights for enterprise leaders.

Tokenization Accelerates Convergence of TradFi and Blockchain Institutions

Tokenization Accelerates Convergence of TradFi and Blockchain Institutions

Tokenization Accelerates Convergence of TradFi and Blockchain Institutions

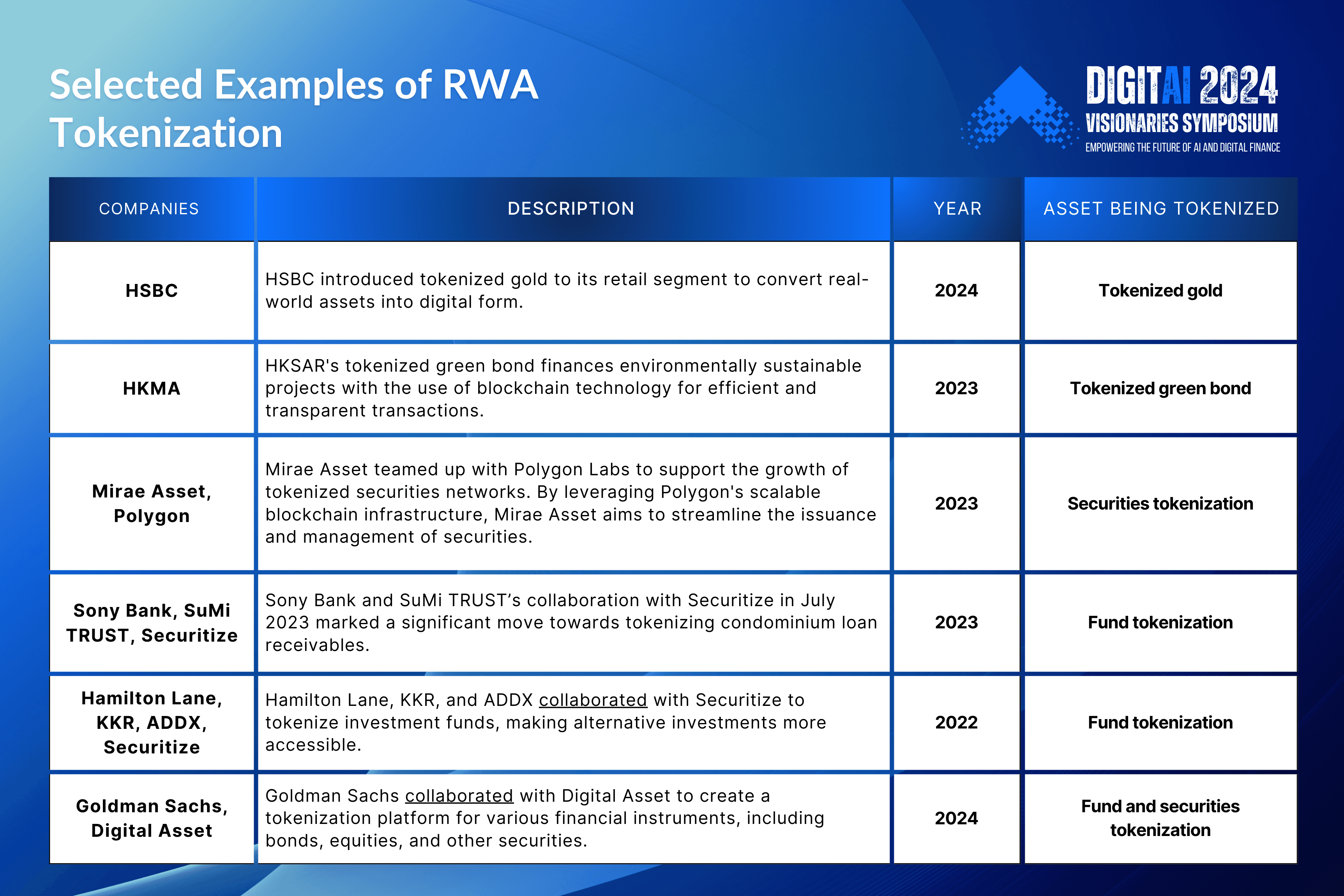

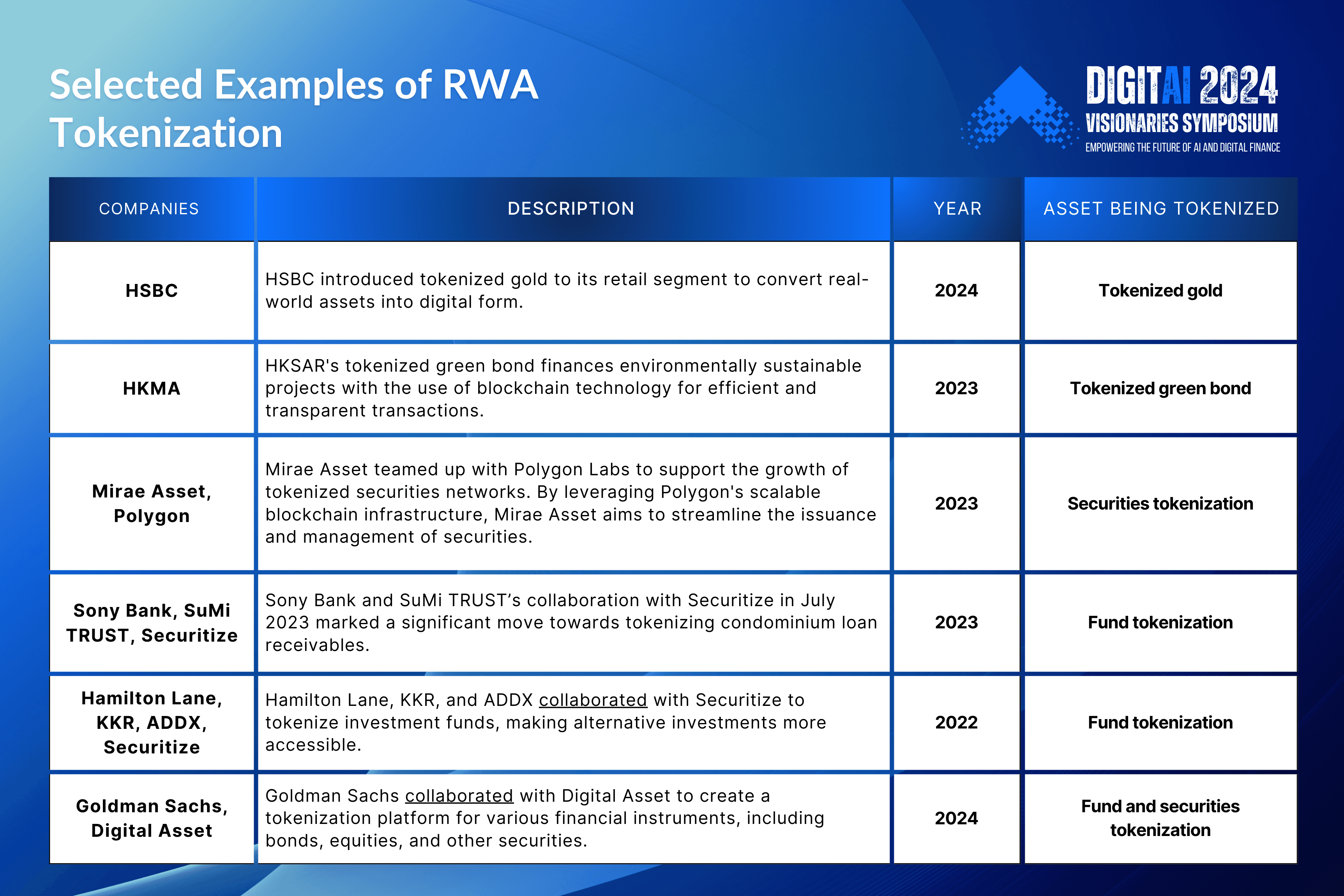

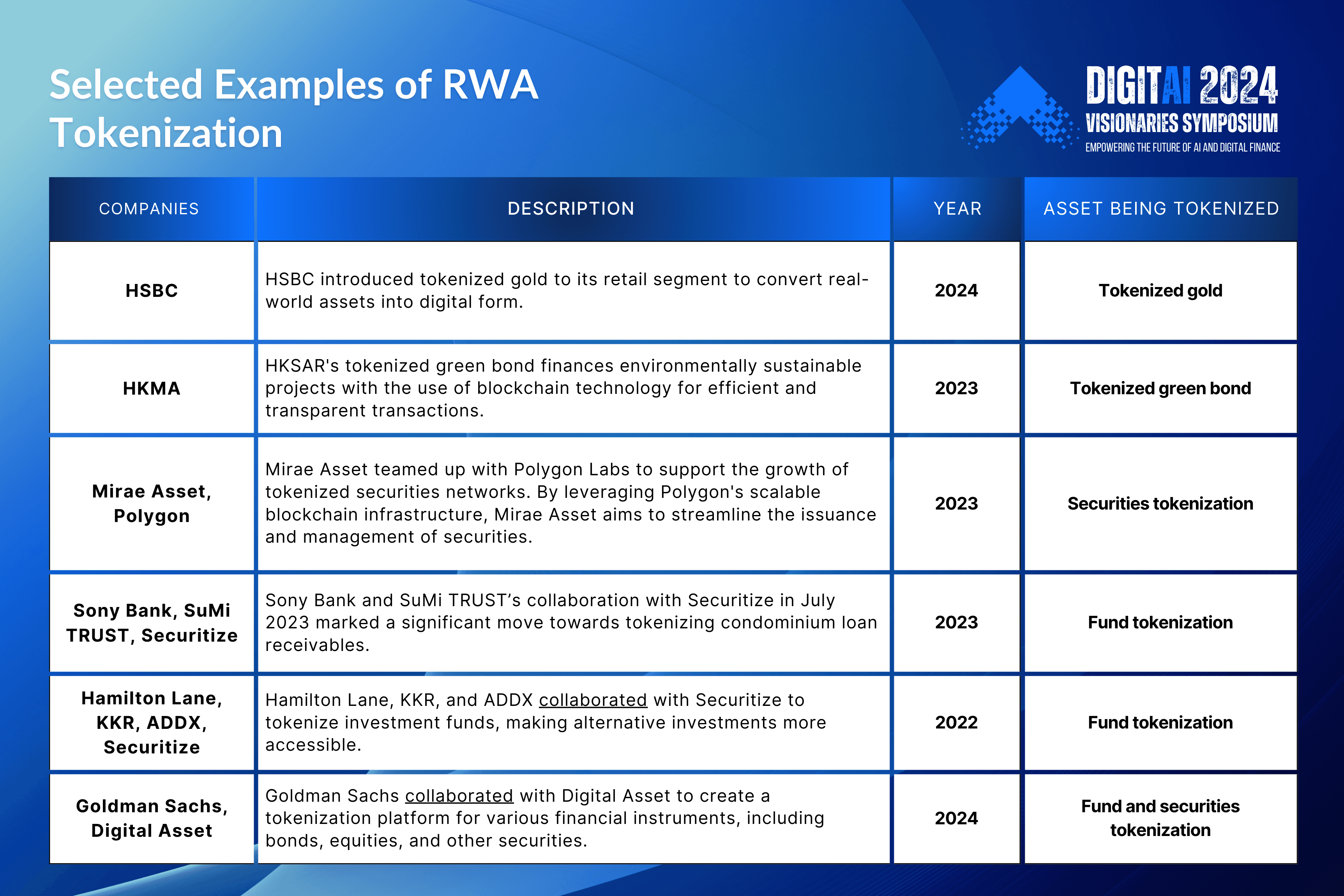

In recent years, the financial industry has witnessed a significant shift as traditional finance (TradFi) institutions increasingly explore the potential of blockchain technology. Through strategic partnerships with blockchain firms, financial institutions are tokenizing assets, streamlining fund management, and introducing innovative financial products.

In recent years, the financial industry has witnessed a significant shift as traditional finance (TradFi) institutions increasingly explore the potential of blockchain technology. Through strategic partnerships with blockchain firms, financial institutions are tokenizing assets, streamlining fund management, and introducing innovative financial products.

In recent years, the financial industry has witnessed a significant shift as traditional finance (TradFi) institutions increasingly explore the potential of blockchain technology. Through strategic partnerships with blockchain firms, financial institutions are tokenizing assets, streamlining fund management, and introducing innovative financial products.

Tokenization Market Size to reach US$2-4tr by 2030

Tokenization Market Size to reach US$2-4tr by 2030

Tokenization Market Size to reach US$2-4tr by 2030

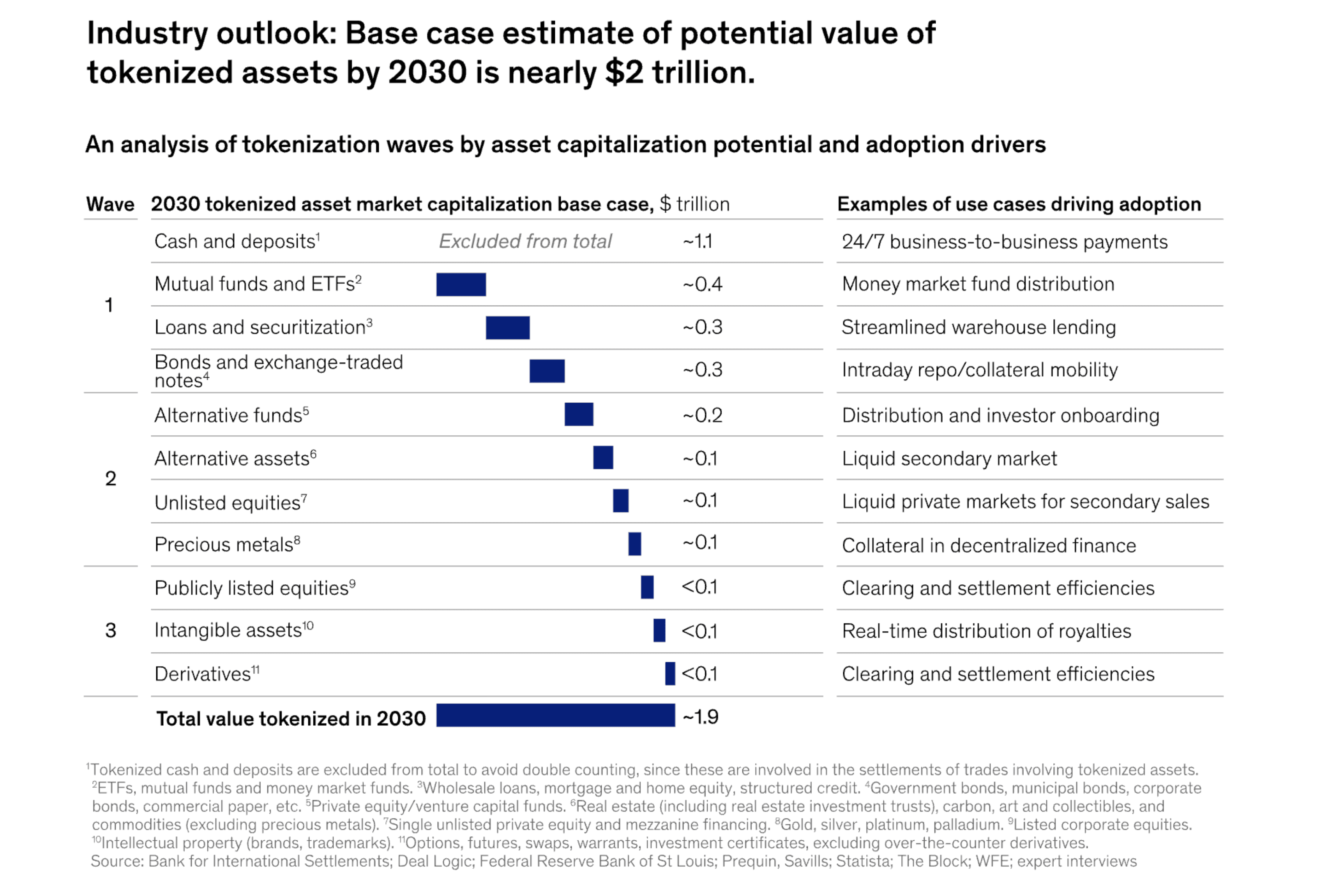

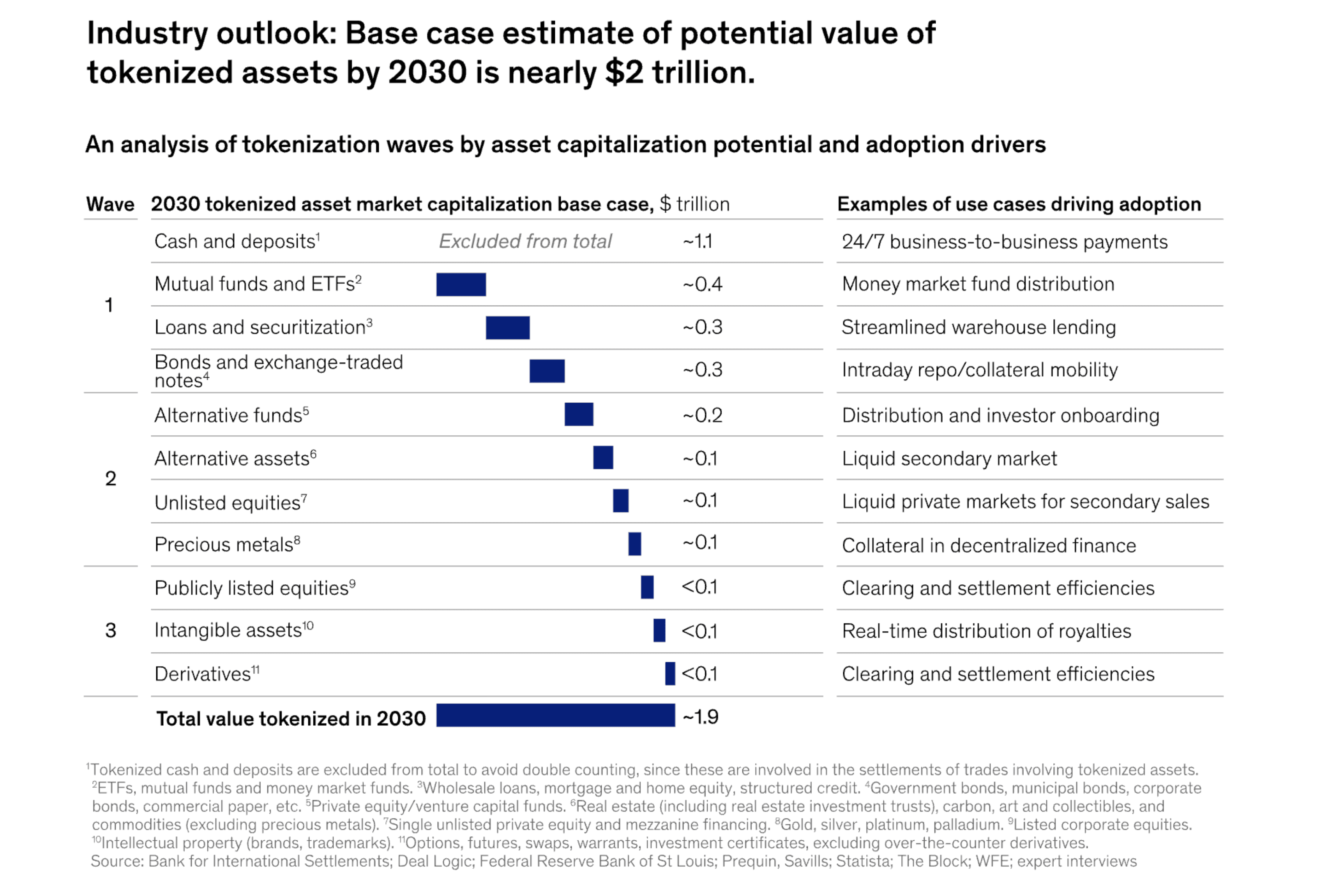

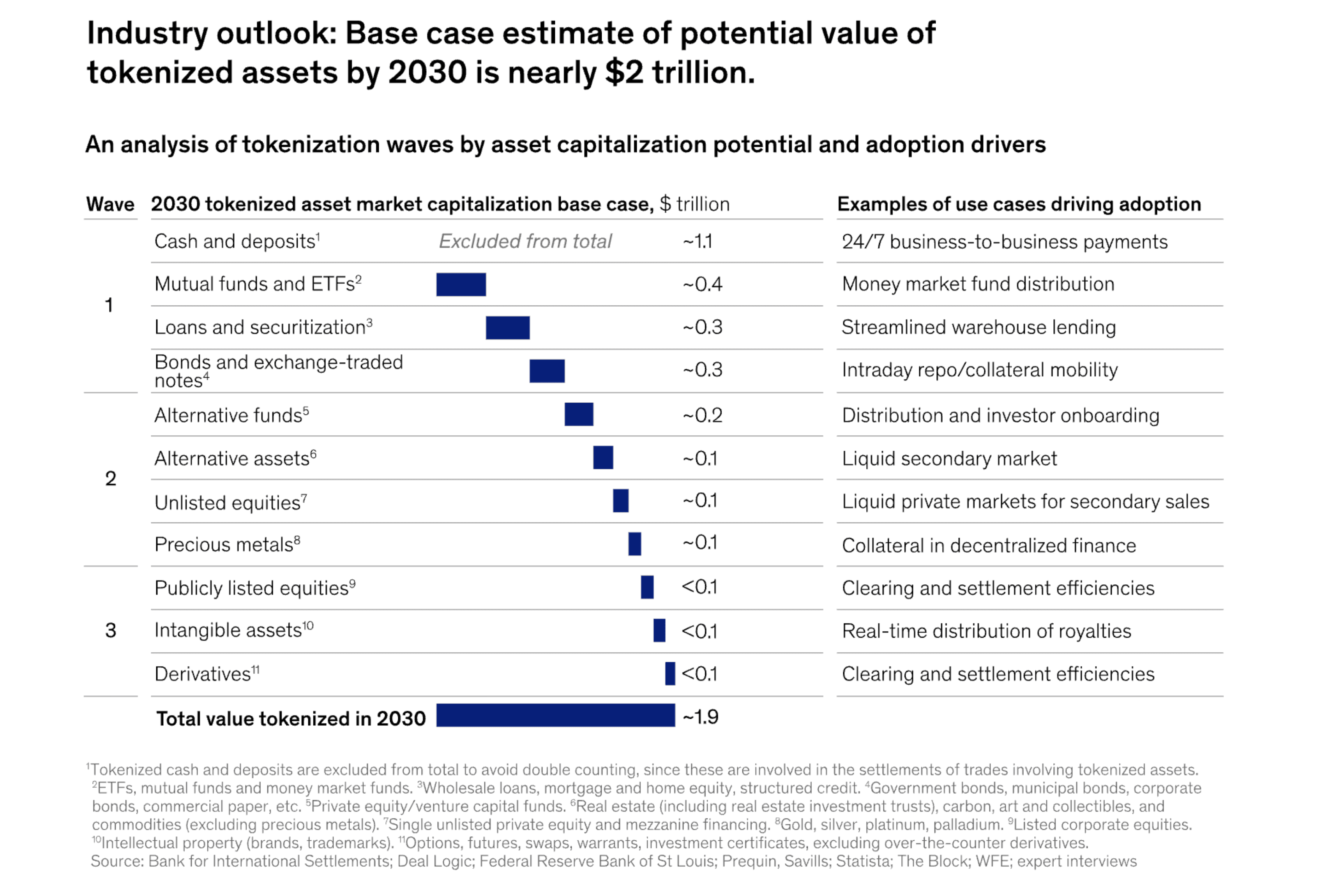

Tokenized assets could reach $2 trillion by 2030, or $4 trillion in a bullish scenario, according to McKinsey. Standard Chartered predicts the market for tokenized real-world assets to reach as high as $30.1 trillion by 2034, further driven by trade finance assets as a new asset class.

Source: McKinsey & Company

For institutional investors, tokenization offers key advantages, such as fractional ownership, enabling smaller investments in high-value assets, and greater market efficiency by reducing the need for intermediaries.

Tokenized assets could reach $2 trillion by 2030, or $4 trillion in a bullish scenario, according to McKinsey. Standard Chartered predicts the market for tokenized real-world assets to reach as high as $30.1 trillion by 2034, further driven by trade finance assets as a new asset class.

Source: McKinsey & Company

For institutional investors, tokenization offers key advantages, such as fractional ownership, enabling smaller investments in high-value assets, and greater market efficiency by reducing the need for intermediaries.

Tokenized assets could reach $2 trillion by 2030, or $4 trillion in a bullish scenario, according to McKinsey. Standard Chartered predicts the market for tokenized real-world assets to reach as high as $30.1 trillion by 2034, further driven by trade finance assets as a new asset class.

Source: McKinsey & Company

For institutional investors, tokenization offers key advantages, such as fractional ownership, enabling smaller investments in high-value assets, and greater market efficiency by reducing the need for intermediaries.

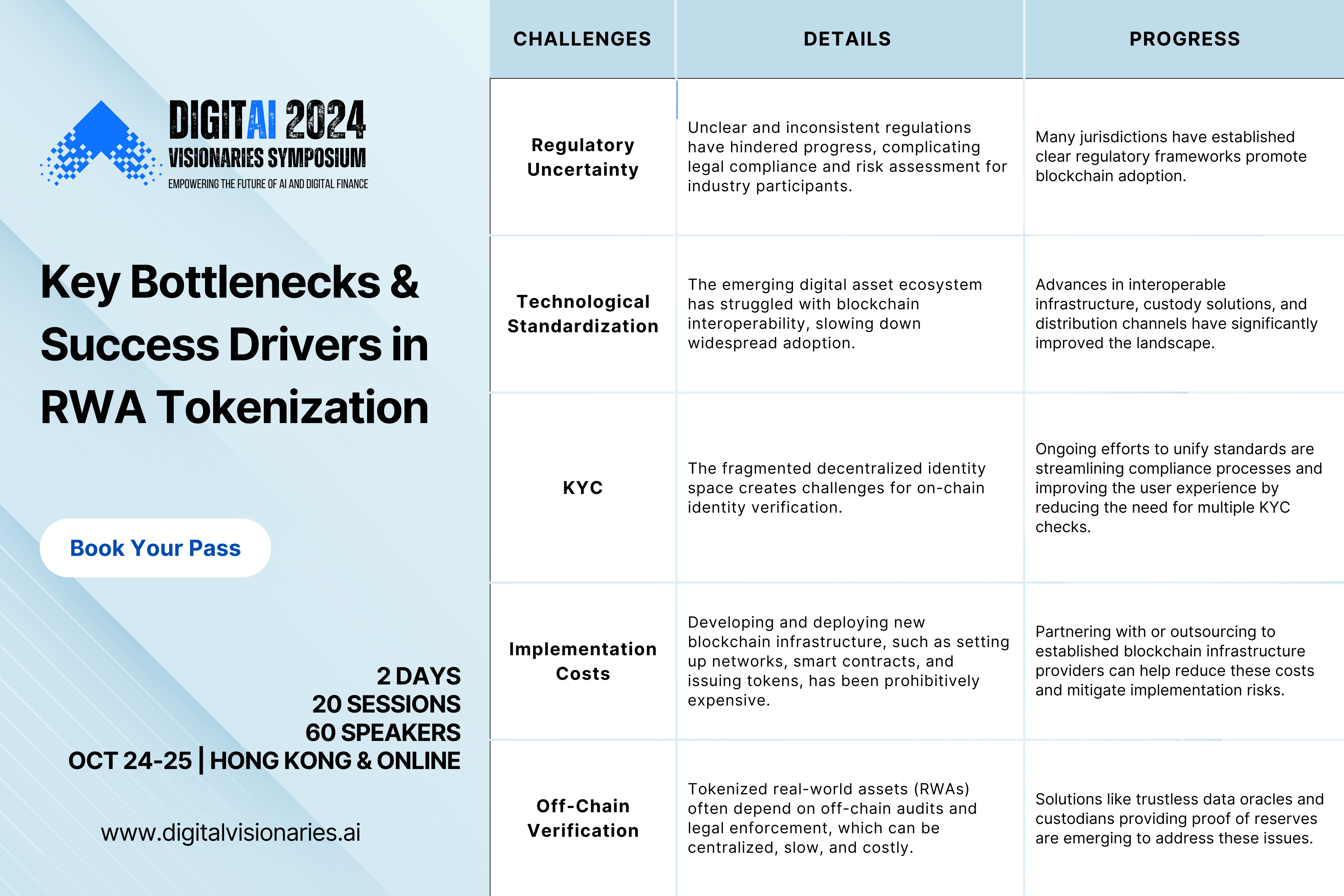

Challenges and Risks in Tokenization

Challenges and Risks in Tokenization

Challenges and Risks in Tokenization

Despite its promises, tokenization still faces uncertainties around regulatory uncertainty, technological standardization, and implementation costs. However, significant progress has been made in addressing these challenges, paving the way for wider acceptance and use.

These solutions reflect the industry's commitment to overcoming barriers to mass adoption, aiming to create a more accessible and efficient blockchain ecosystem.

Despite its promises, tokenization still faces uncertainties around regulatory uncertainty, technological standardization, and implementation costs. However, significant progress has been made in addressing these challenges, paving the way for wider acceptance and use.

These solutions reflect the industry's commitment to overcoming barriers to mass adoption, aiming to create a more accessible and efficient blockchain ecosystem.

Despite its promises, tokenization still faces uncertainties around regulatory uncertainty, technological standardization, and implementation costs. However, significant progress has been made in addressing these challenges, paving the way for wider acceptance and use.

These solutions reflect the industry's commitment to overcoming barriers to mass adoption, aiming to create a more accessible and efficient blockchain ecosystem.

Tokenization offers institutional investors new opportunities, such as fractional ownership of high-value assets like luxury real estate. This enhances portfolio diversification, speeds up transactions, and aligns with the ongoing digital transformation in finance. Key benefits include:

Increased Liquidity

Through fractional ownership, tokenization opens access to assets that are typically difficult to trade, making them more liquid and available to a broader pool of investors.

Permanent Transparency

Blockchain technology ensures that all transactions are securely and permanently recorded on-chain, providing a transparent and easily auditable record for anyone.

Enhanced Security

The decentralized and encrypted nature of blockchain adds a robust layer of security, safeguarding assets against unauthorized access and potential fraud.

Simplified Asset Management

Tokenization enables the seamless lending, borrowing, and division of traditionally illiquid assets, reducing costs and making asset management more efficient.

Global Accessibility

With tokenization, assets can be traded around the clock, and cross-border transactions can be settled with ease, removing geographical limitations and ensuring continuous market access.

Improved Efficiency

By cutting out intermediaries, tokenization streamlines transactions, resulting in faster processing, better price discovery, and significant cost savings.

Strategically, tokenization allows investors to future-proof their portfolios, positioning them at the forefront of digital finance innovation. As technological, regulatory, and AI advancements continue, understanding these trends will help investors leverage tokenization’s long-term potential.

Tokenization offers institutional investors new opportunities, such as fractional ownership of high-value assets like luxury real estate. This enhances portfolio diversification, speeds up transactions, and aligns with the ongoing digital transformation in finance. Key benefits include:

Increased Liquidity

Through fractional ownership, tokenization opens access to assets that are typically difficult to trade, making them more liquid and available to a broader pool of investors.

Permanent Transparency

Blockchain technology ensures that all transactions are securely and permanently recorded on-chain, providing a transparent and easily auditable record for anyone.

Enhanced Security

The decentralized and encrypted nature of blockchain adds a robust layer of security, safeguarding assets against unauthorized access and potential fraud.

Simplified Asset Management

Tokenization enables the seamless lending, borrowing, and division of traditionally illiquid assets, reducing costs and making asset management more efficient.

Global Accessibility

With tokenization, assets can be traded around the clock, and cross-border transactions can be settled with ease, removing geographical limitations and ensuring continuous market access.

Improved Efficiency

By cutting out intermediaries, tokenization streamlines transactions, resulting in faster processing, better price discovery, and significant cost savings.

Strategically, tokenization allows investors to future-proof their portfolios, positioning them at the forefront of digital finance innovation. As technological, regulatory, and AI advancements continue, understanding these trends will help investors leverage tokenization’s long-term potential.

Tokenization offers institutional investors new opportunities, such as fractional ownership of high-value assets like luxury real estate. This enhances portfolio diversification, speeds up transactions, and aligns with the ongoing digital transformation in finance. Key benefits include:

Increased Liquidity

Through fractional ownership, tokenization opens access to assets that are typically difficult to trade, making them more liquid and available to a broader pool of investors.

Permanent Transparency

Blockchain technology ensures that all transactions are securely and permanently recorded on-chain, providing a transparent and easily auditable record for anyone.

Enhanced Security

The decentralized and encrypted nature of blockchain adds a robust layer of security, safeguarding assets against unauthorized access and potential fraud.

Simplified Asset Management

Tokenization enables the seamless lending, borrowing, and division of traditionally illiquid assets, reducing costs and making asset management more efficient.

Global Accessibility

With tokenization, assets can be traded around the clock, and cross-border transactions can be settled with ease, removing geographical limitations and ensuring continuous market access.

Improved Efficiency

By cutting out intermediaries, tokenization streamlines transactions, resulting in faster processing, better price discovery, and significant cost savings.

Strategically, tokenization allows investors to future-proof their portfolios, positioning them at the forefront of digital finance innovation. As technological, regulatory, and AI advancements continue, understanding these trends will help investors leverage tokenization’s long-term potential.

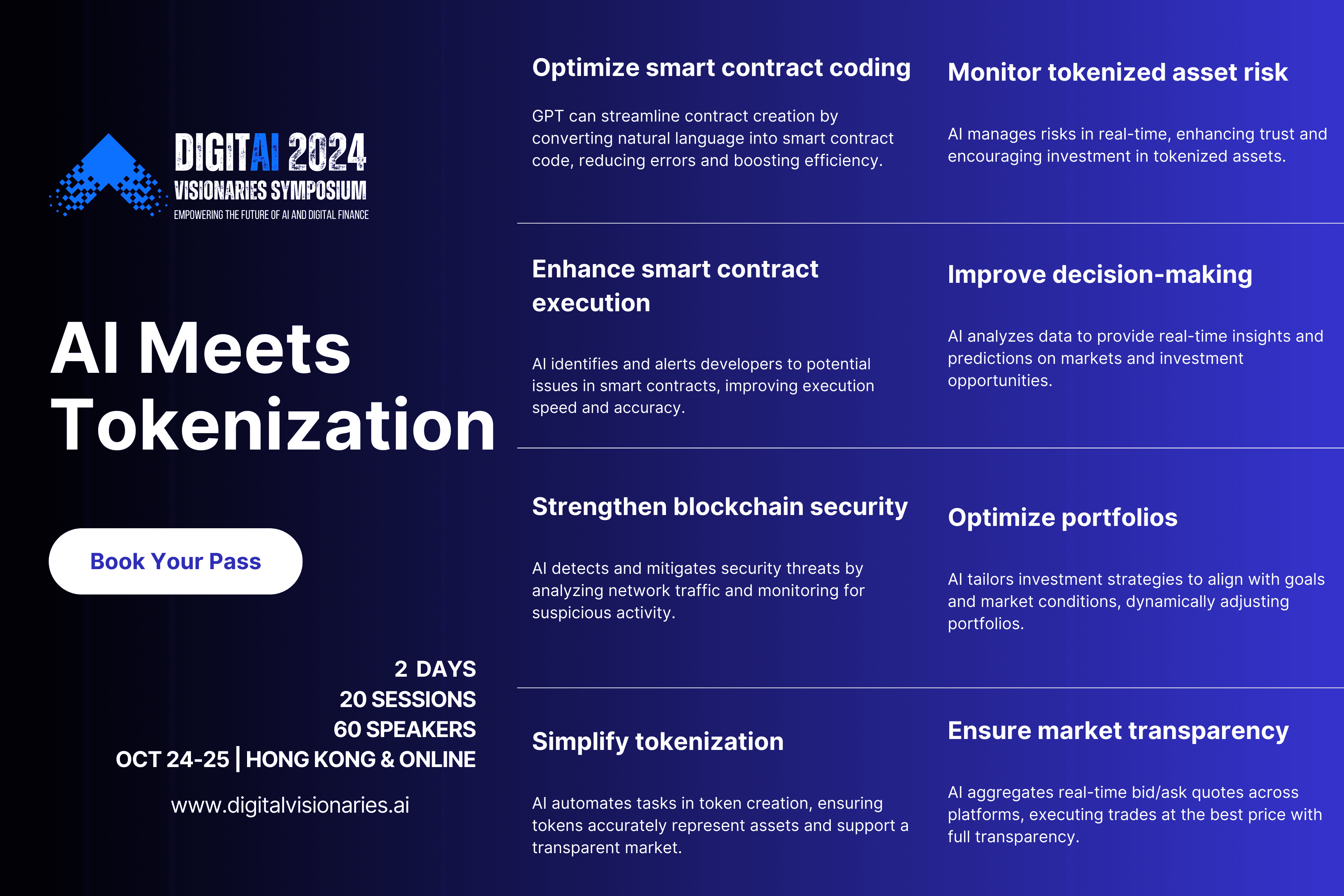

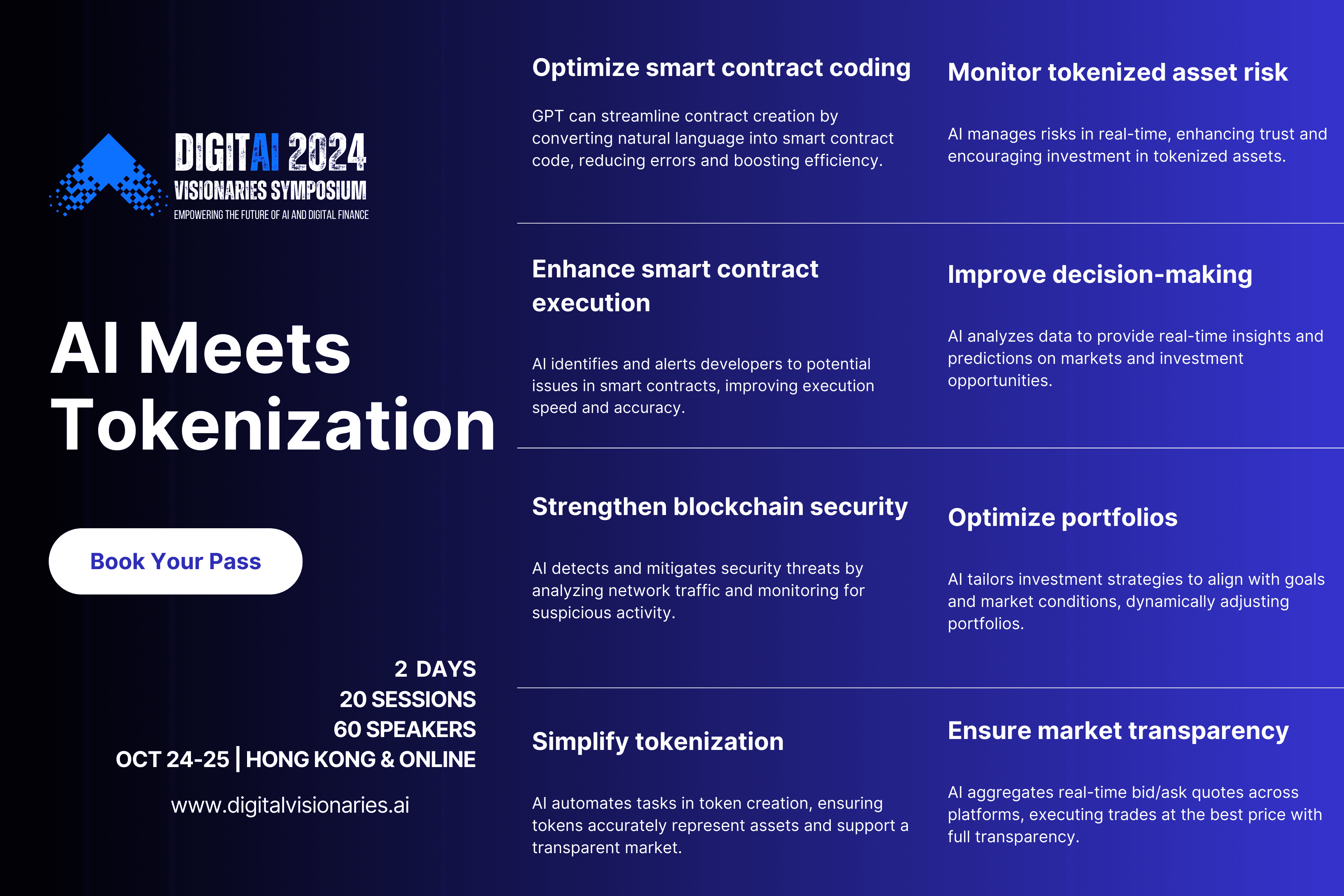

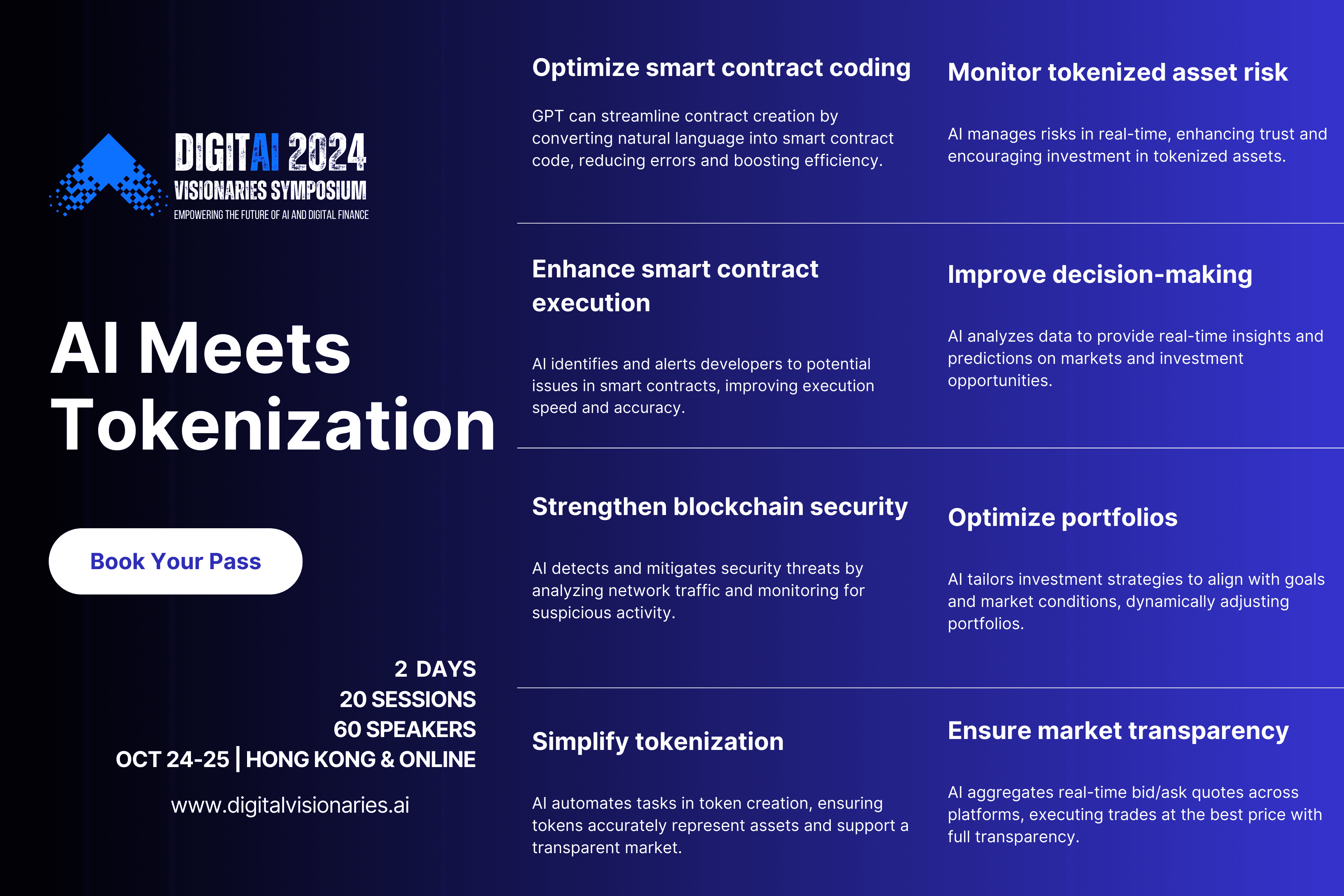

AI will enhance tokenized markets by automating asset valuation, due diligence, and compliance, reducing time and costs. AI-powered smart contracts can also execute transactions automatically based on set conditions, minimizing manual intervention and lowering the risk of errors.

Source: Nasdaq

AI will enhance tokenized markets by automating asset valuation, due diligence, and compliance, reducing time and costs. AI-powered smart contracts can also execute transactions automatically based on set conditions, minimizing manual intervention and lowering the risk of errors.

Source: Nasdaq

AI will enhance tokenized markets by automating asset valuation, due diligence, and compliance, reducing time and costs. AI-powered smart contracts can also execute transactions automatically based on set conditions, minimizing manual intervention and lowering the risk of errors.

Source: Nasdaq

Join us in Hong Kong or online on October 24-25, 2024:

Secure Your Spot: Register now to attend and gain insights from industry leaders.

Explore Sponsorship: Elevate your brand by becoming a sponsor and showcasing your leadership in financial innovation.

Partner with Us: Partner with us as a supporting organization to influence industry evolution.

Influence the Future

Prepare to contribute your insights and showcase your expertise. Our upcoming feature will enable you to shape global discussions and demonstrate thought leadership.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong