Table of contents

Subscribe to DVS 2024

Sign up now to get access to the library of members-only issues.

Future-Ready Finance: Exploring the Impact of Enterprise AI on the Financial Sector

Future-Ready Finance: Exploring the Impact of Enterprise AI on the Financial Sector

Future-Ready Finance: Exploring the Impact of Enterprise AI on the Financial Sector

Insights & Trends

Insights & Trends

7 minutes

7 minutes

Aug 20, 2024

Aug 20, 2024

AI is transforming the financial services sector with innovations such as automated trading, AI-powered customer service and advanced fraud detection systems, significantly enhancing efficiency and security.

AI offers transformative prospects in personalized investment strategies and risk management, while also raising important concerns about data privacy and regulatory challenges.

The Digital Visionaries Symposium 2024 will feature in-depth discussions by global industry leaders on the profound impact and future implications of AI in finance. Join us on October 24-25, 2024, in Hong Kong and online!

Day 1 Theme: Enterprise AI in Finance – On October 24, 2024, join us for a deep drive into how AI applications will continue to revolutionize financial services in 2025 and beyond. Engage with industry leaders, attend insightful sessions and workshops to gain the knowledge you need to stay ahead.

Pre-register to secure your spot!

AI is transforming the financial services sector with innovations such as automated trading, AI-powered customer service and advanced fraud detection systems, significantly enhancing efficiency and security.

AI offers transformative prospects in personalized investment strategies and risk management, while also raising important concerns about data privacy and regulatory challenges.

The Digital Visionaries Symposium 2024 will feature in-depth discussions by global industry leaders on the profound impact and future implications of AI in finance. Join us on October 24-25, 2024, in Hong Kong and online!

Day 1 Theme: Enterprise AI in Finance – On October 24, 2024, join us for a deep drive into how AI applications will continue to revolutionize financial services in 2025 and beyond. Engage with industry leaders, attend insightful sessions and workshops to gain the knowledge you need to stay ahead.

Pre-register to secure your spot!

AI is transforming the financial services sector with innovations such as automated trading, AI-powered customer service and advanced fraud detection systems, significantly enhancing efficiency and security.

AI offers transformative prospects in personalized investment strategies and risk management, while also raising important concerns about data privacy and regulatory challenges.

The Digital Visionaries Symposium 2024 will feature in-depth discussions by global industry leaders on the profound impact and future implications of AI in finance. Join us on October 24-25, 2024, in Hong Kong and online!

Day 1 Theme: Enterprise AI in Finance – On October 24, 2024, join us for a deep drive into how AI applications will continue to revolutionize financial services in 2025 and beyond. Engage with industry leaders, attend insightful sessions and workshops to gain the knowledge you need to stay ahead.

Pre-register to secure your spot!

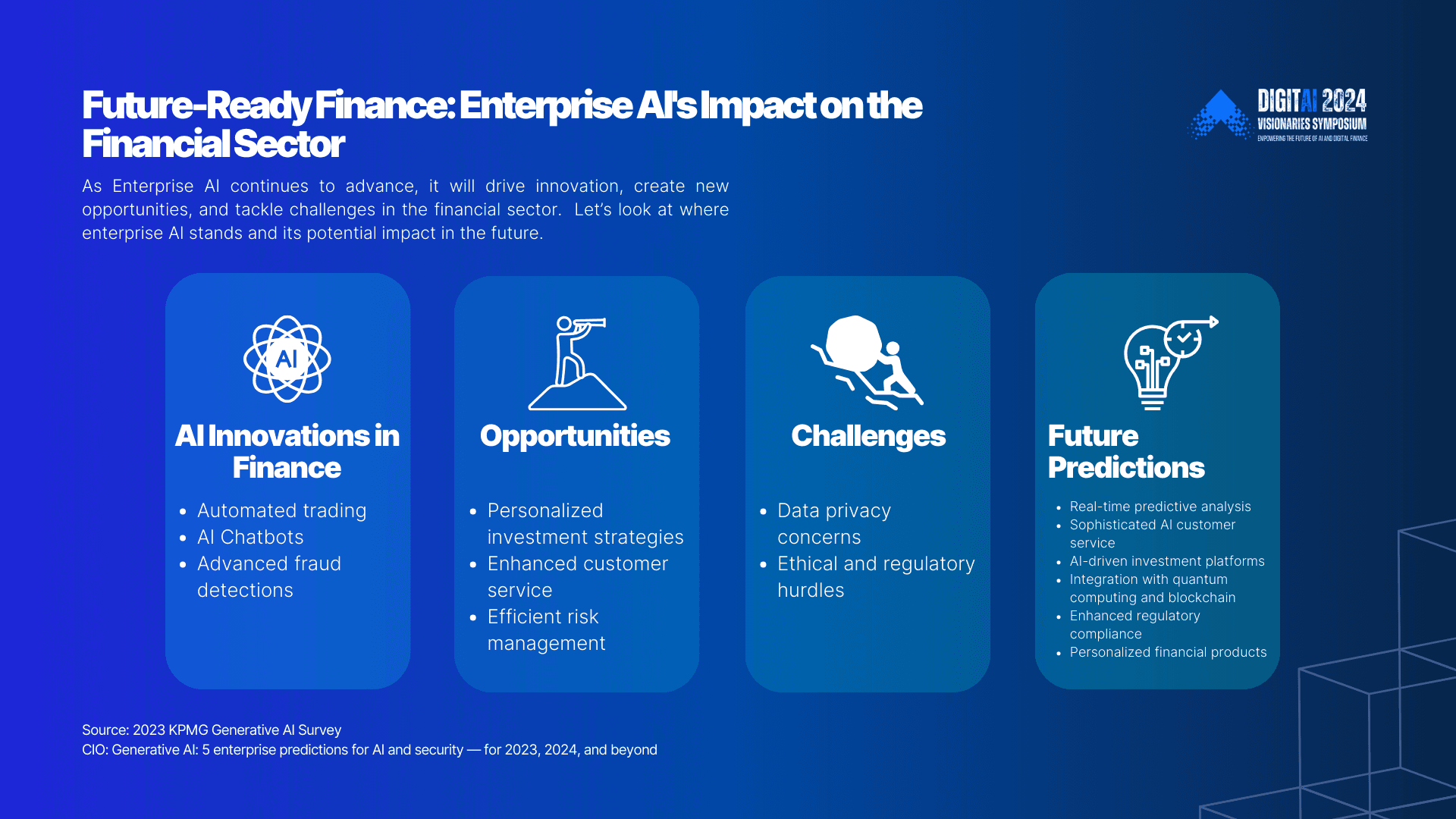

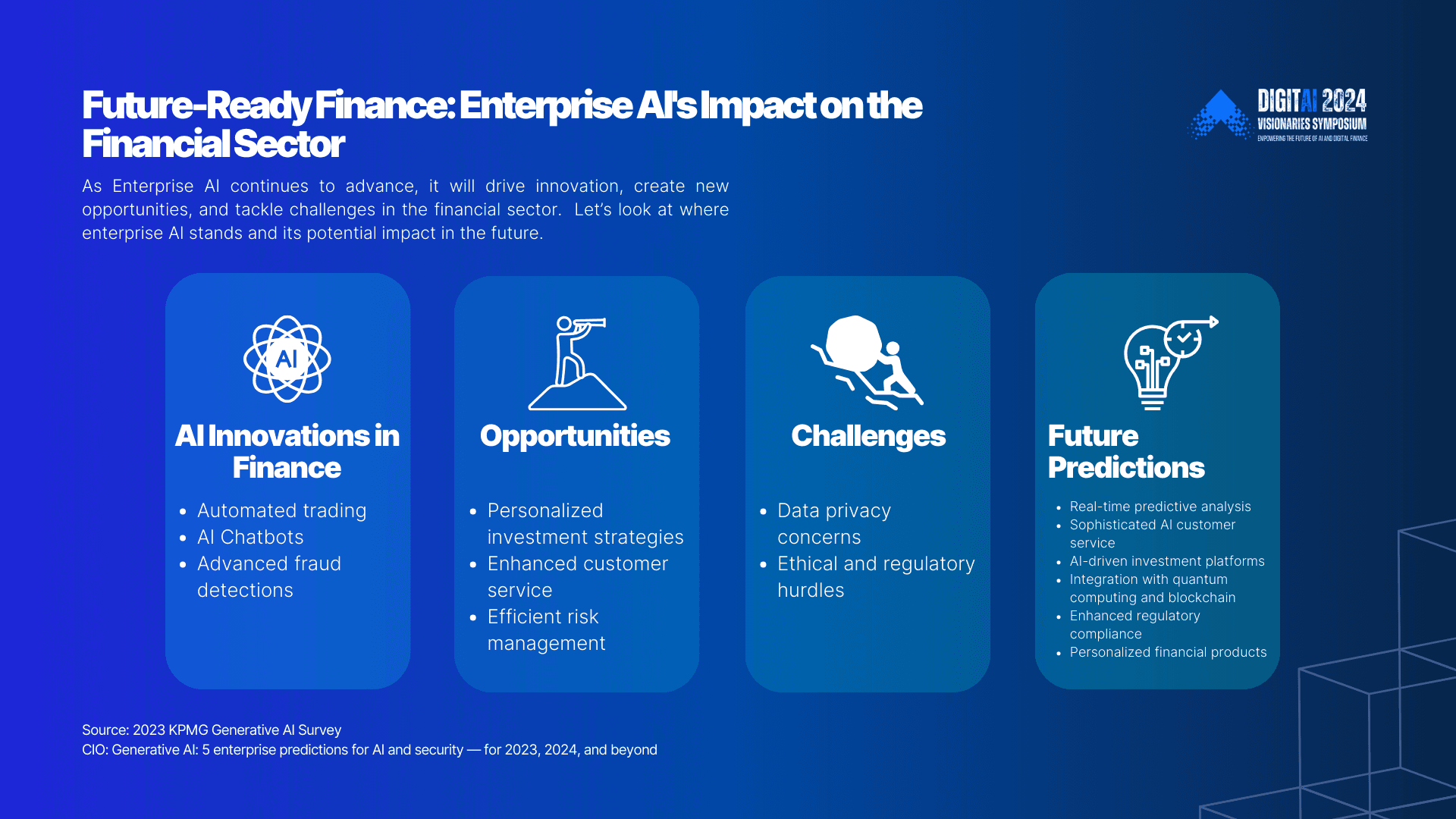

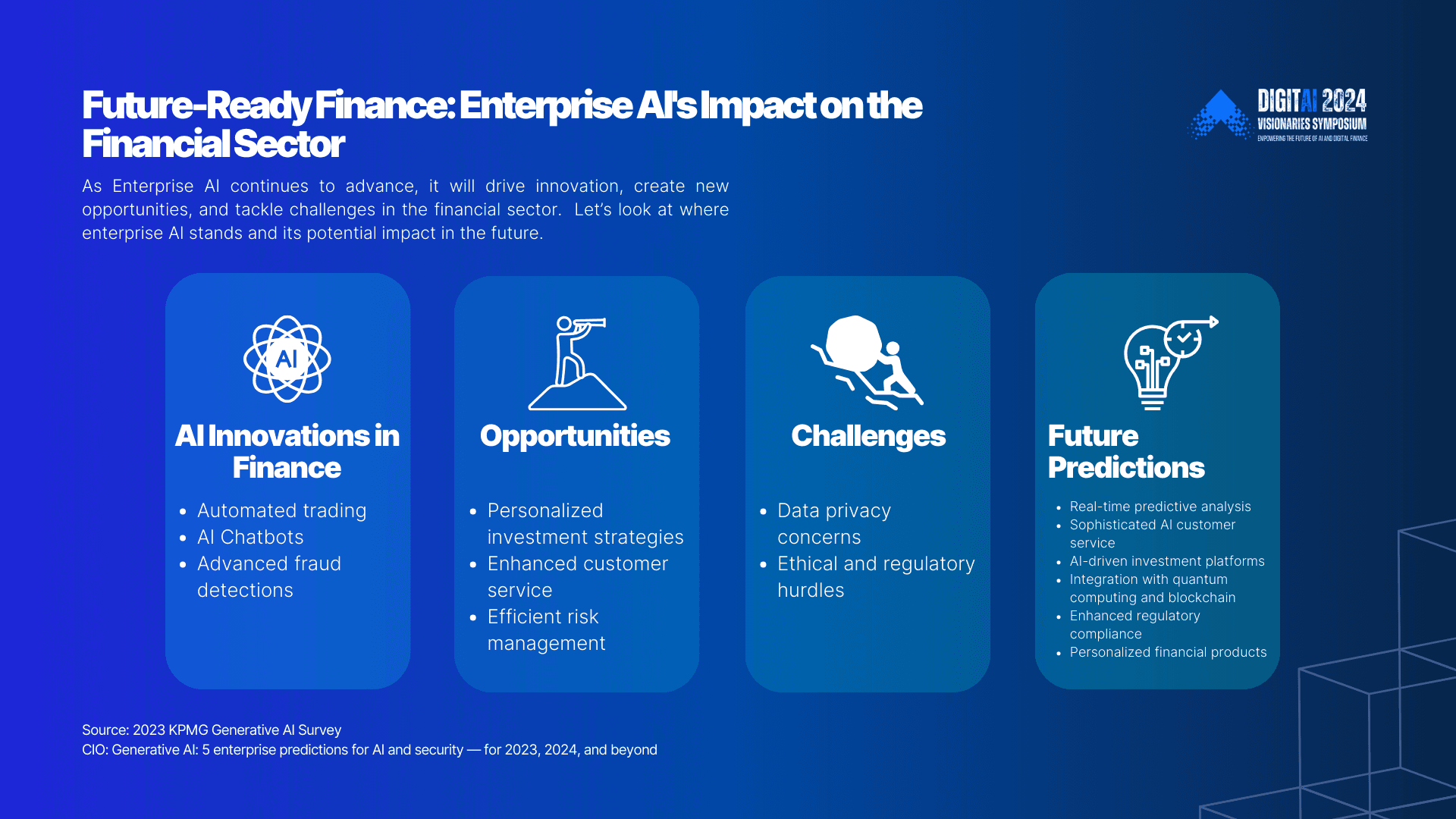

AI is transforming the financial landscape, revolutionizing systems and processes in tech and finance. This shift is not just a trend but a fundamental change, driving innovation, creating opportunities, and addressing challenges in the financial sector. Let’s look at where AI applications in finance stands and its potential impact in the future.

AI is transforming the financial landscape, revolutionizing systems and processes in tech and finance. This shift is not just a trend but a fundamental change, driving innovation, creating opportunities, and addressing challenges in the financial sector. Let’s look at where AI applications in finance stands and its potential impact in the future.

AI is transforming the financial landscape, revolutionizing systems and processes in tech and finance. This shift is not just a trend but a fundamental change, driving innovation, creating opportunities, and addressing challenges in the financial sector. Let’s look at where AI applications in finance stands and its potential impact in the future.

How Enterprise AI is shaping the financial landscape

How Enterprise AI is shaping the financial landscape

How Enterprise AI is shaping the financial landscape

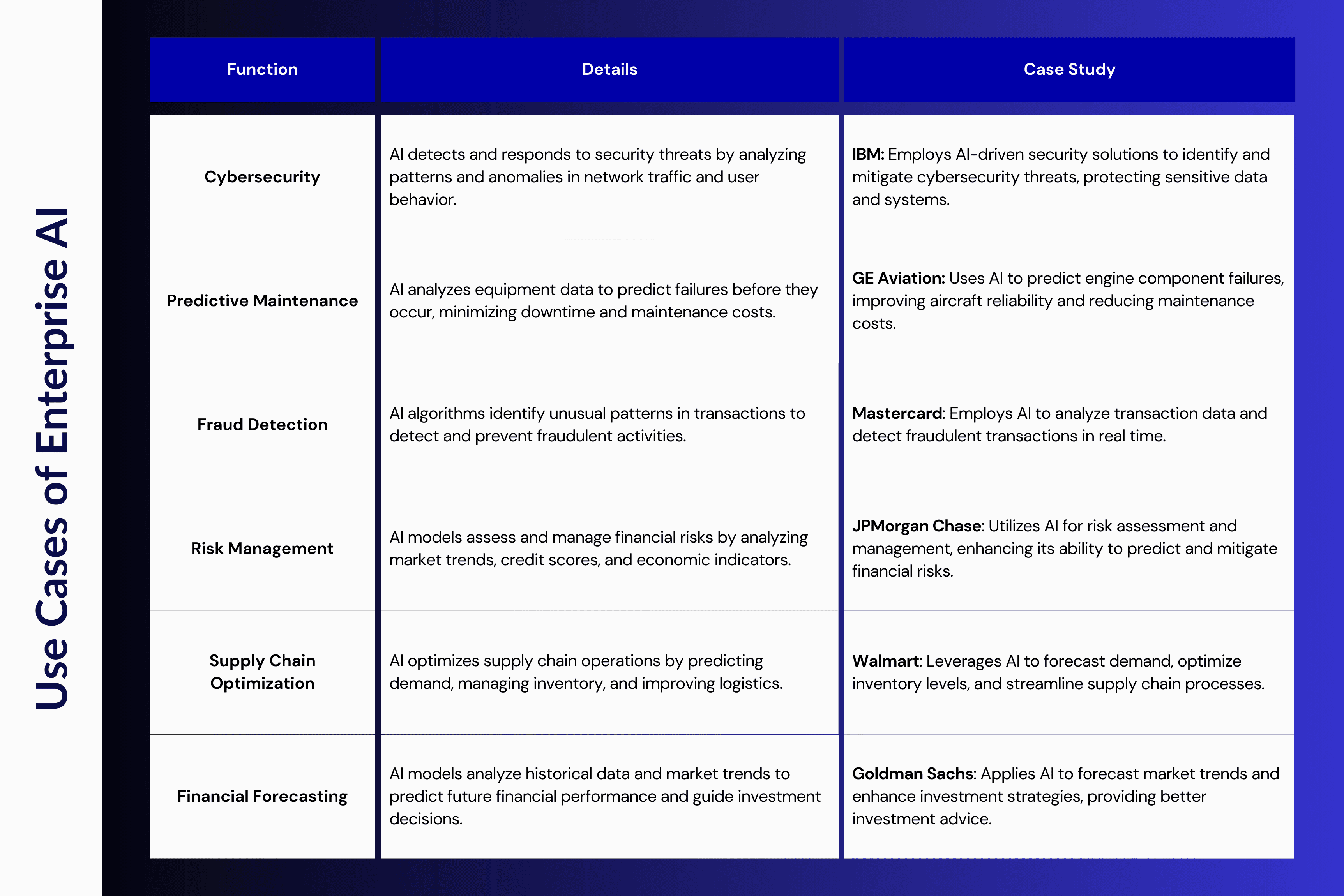

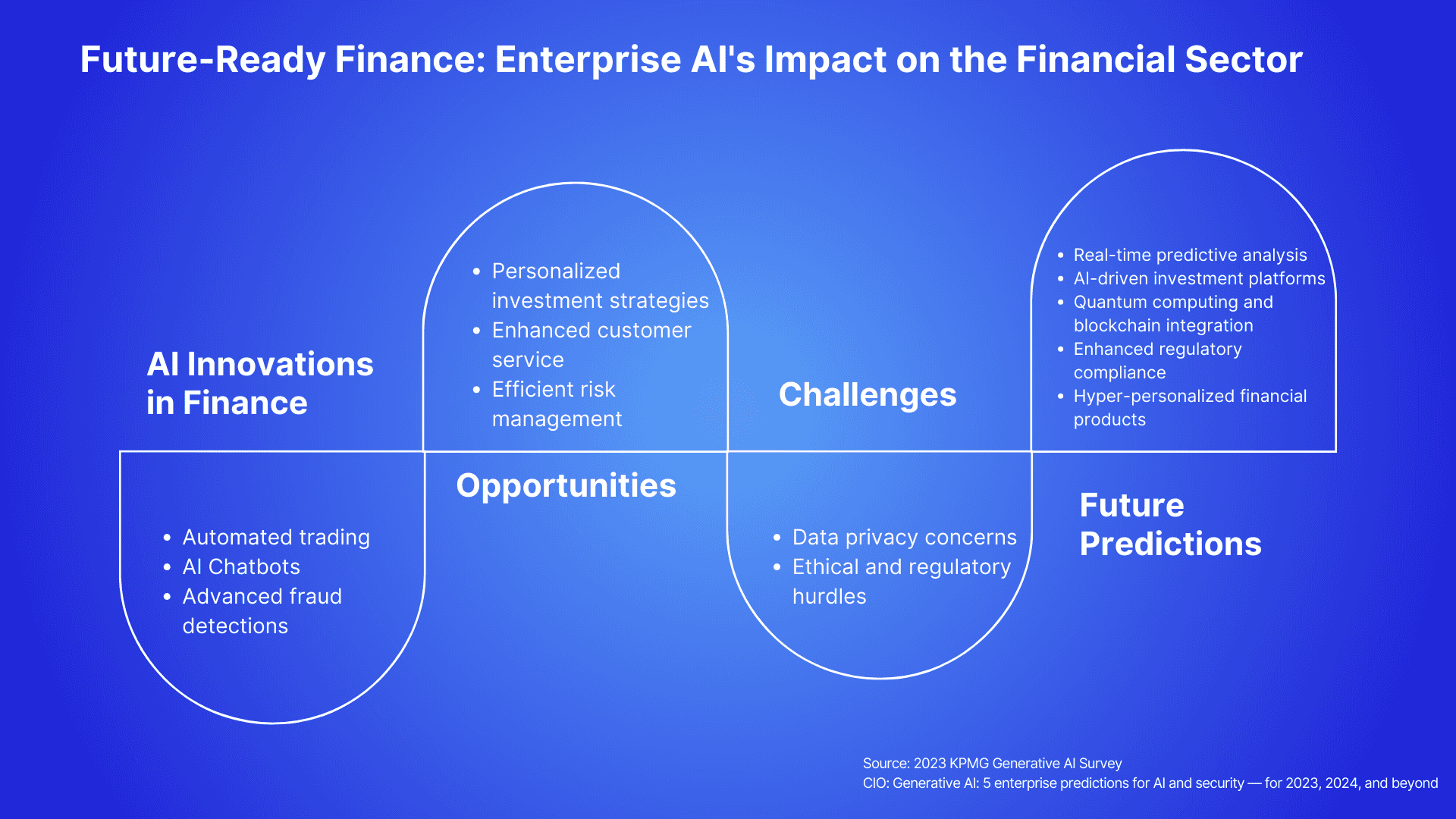

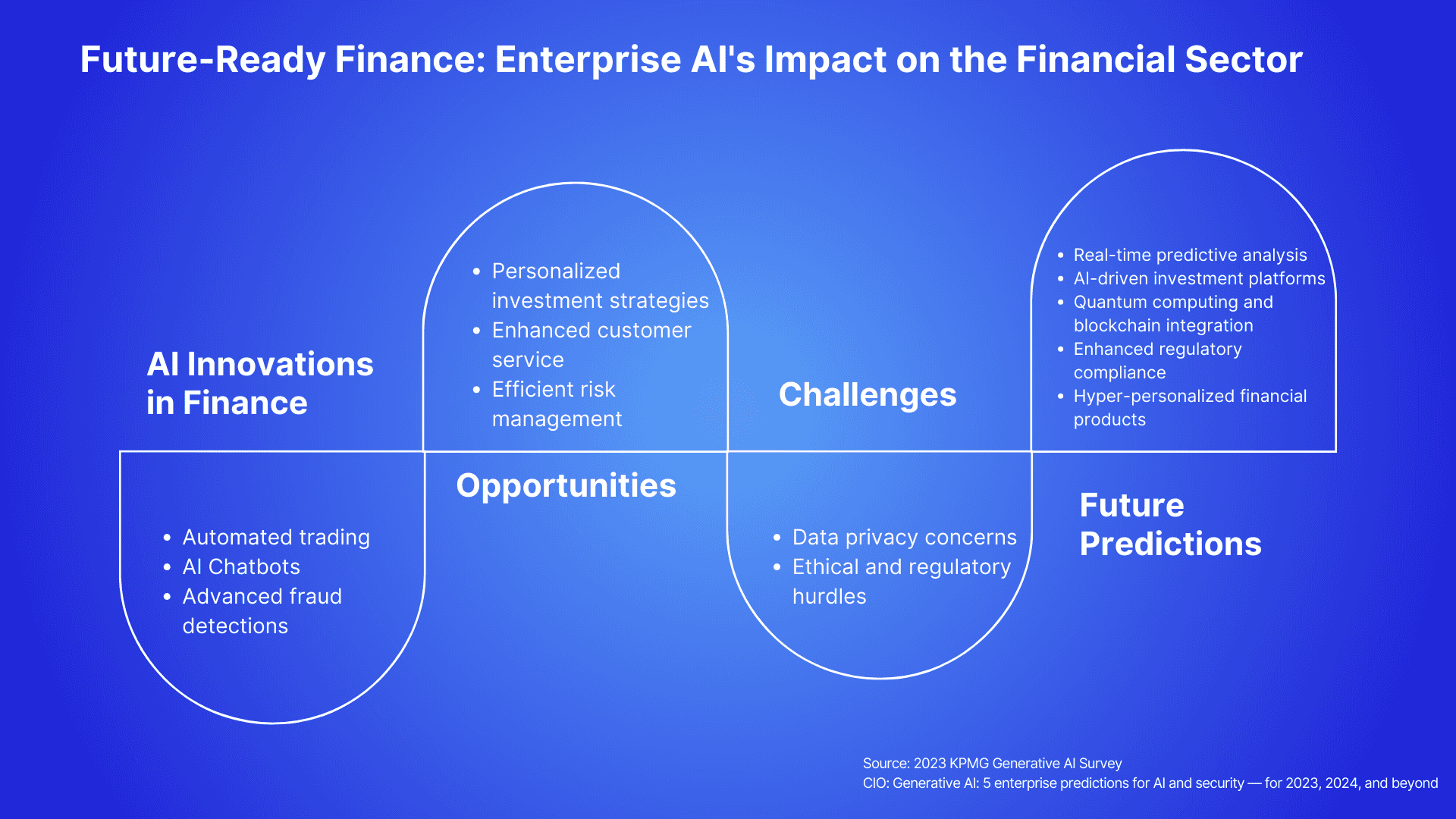

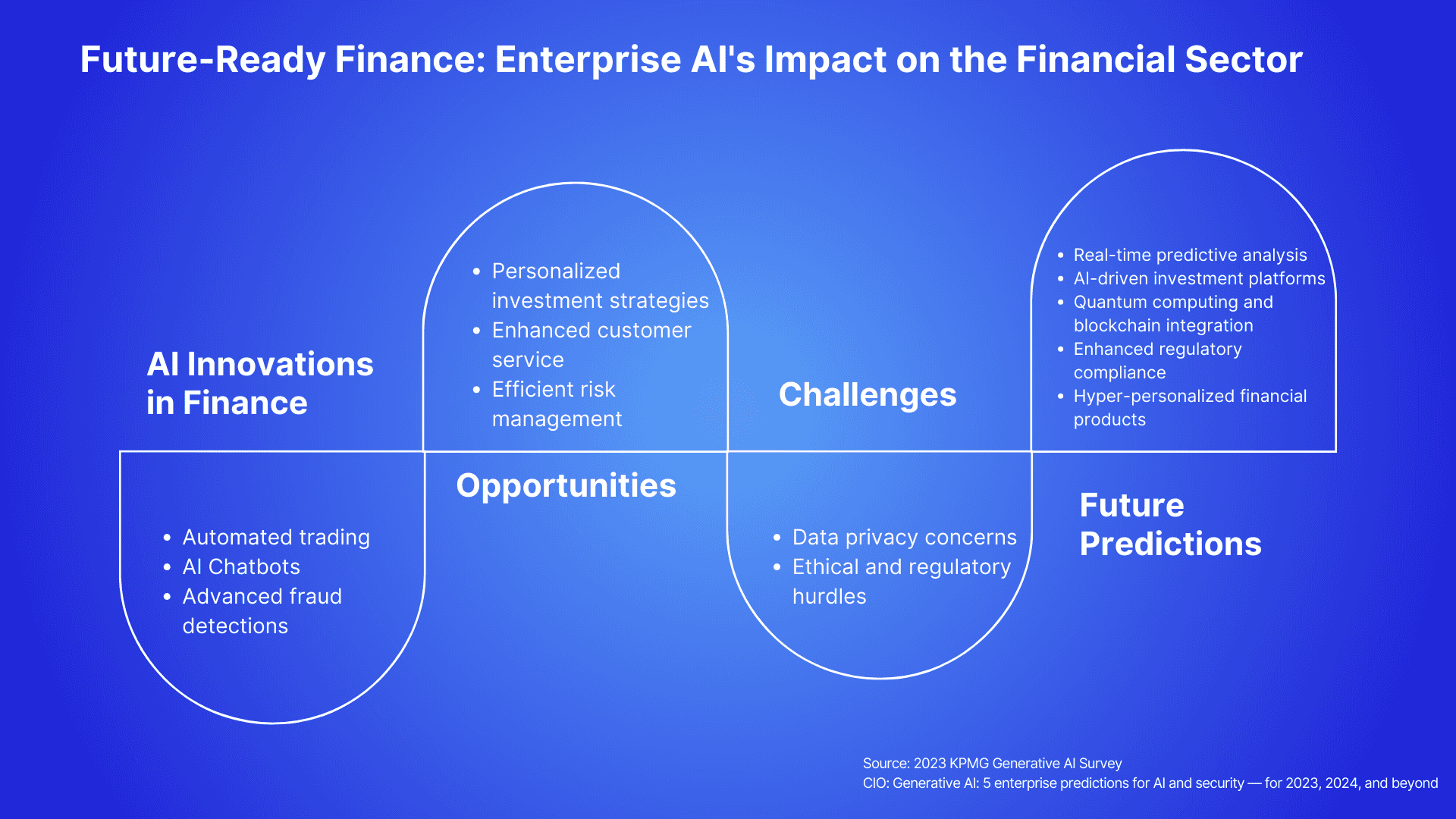

Enterprise AI is revolutionizing financial services with automated trading algorithms, AI chatbots, and advanced fraud detection analytics. A 2023 KPMG study shows that 59% of finance managers at companies with over $1 billion in sales are using AI for financial processes.

Generative AI is also gaining traction across major financial institutions. JPMorgan Chase recently launched the LLM Suite, a generative AI tool that enhances productivity and decision-making for over 50,000 employees. Goldman Sachs employees genAI to streamline code generation, and Mastercard leverages it to bolster AI-driven fraud detection, significantly improving security.

These innovations highlight AI’s pivotal role in advancing financial services and setting new standards for efficiency and security.

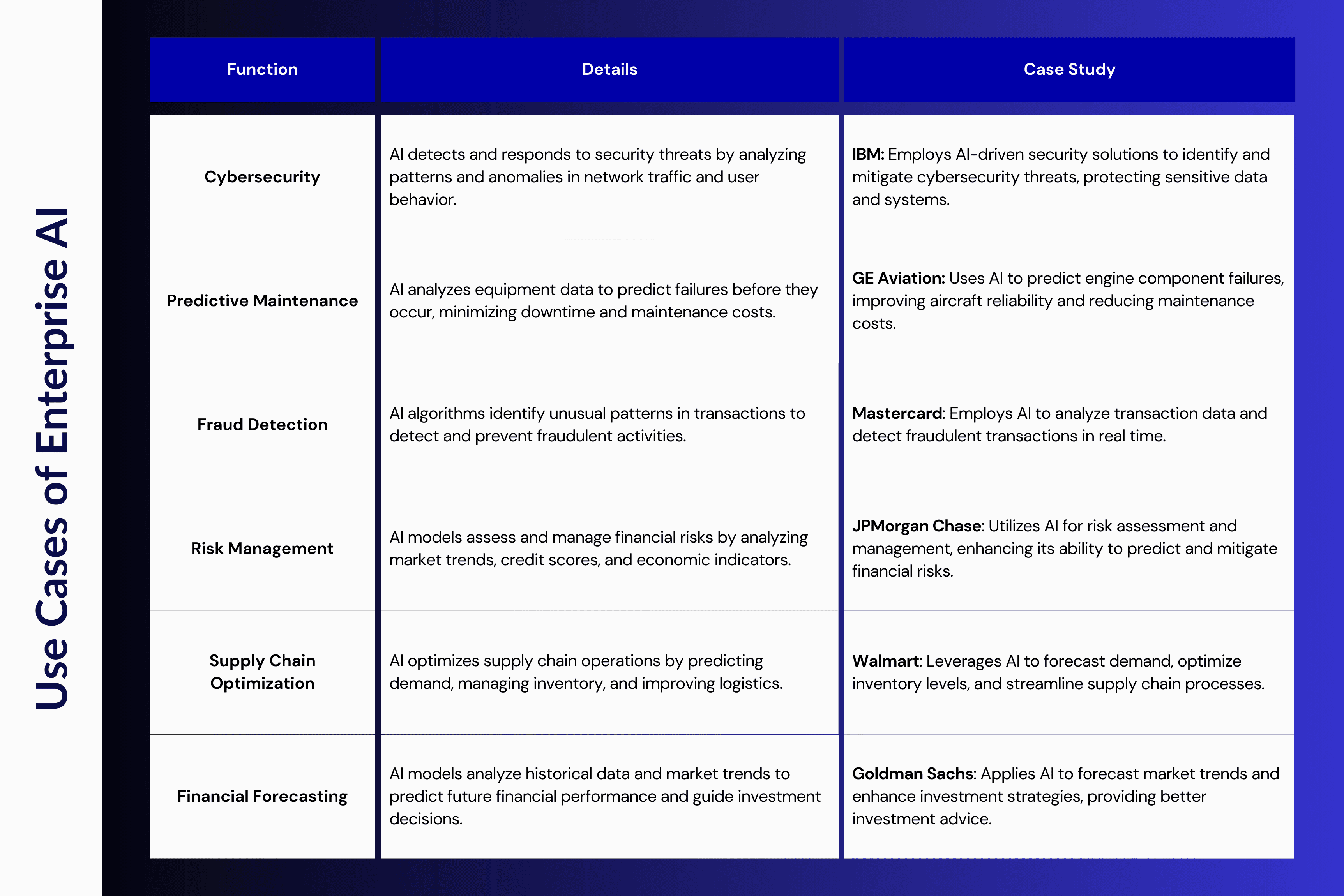

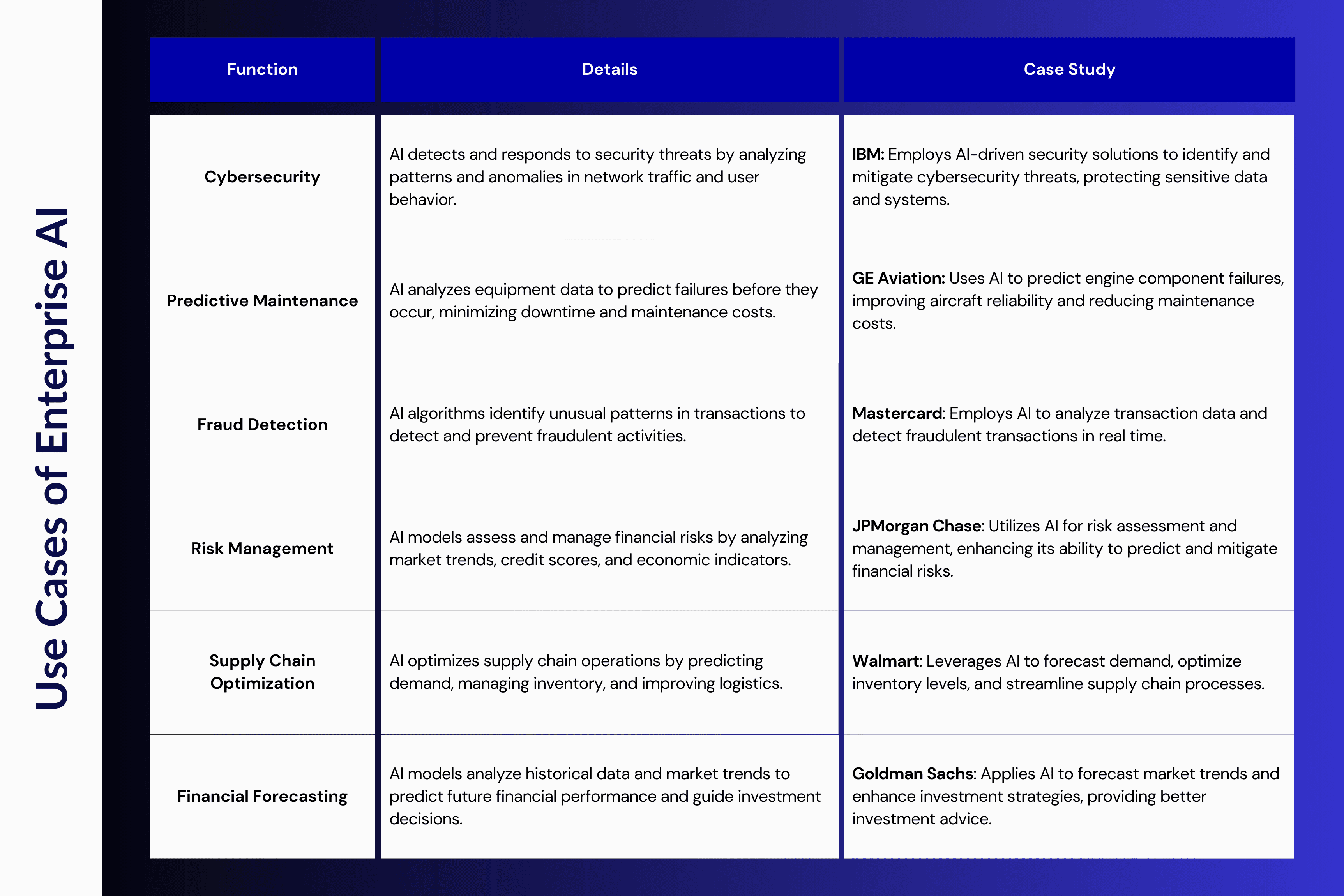

An overview of the diverse applications of Enterprise AI across various functions, from cybersecurity to financial forecasting, highlighting case studies from leading companies.

Enterprise AI is revolutionizing financial services with automated trading algorithms, AI chatbots, and advanced fraud detection analytics. A 2023 KPMG study shows that 59% of finance managers at companies with over $1 billion in sales are using AI for financial processes.

Generative AI is also gaining traction across major financial institutions. JPMorgan Chase recently launched the LLM Suite, a generative AI tool that enhances productivity and decision-making for over 50,000 employees. Goldman Sachs employees genAI to streamline code generation, and Mastercard leverages it to bolster AI-driven fraud detection, significantly improving security.

These innovations highlight AI’s pivotal role in advancing financial services and setting new standards for efficiency and security.

An overview of the diverse applications of Enterprise AI across various functions, from cybersecurity to financial forecasting, highlighting case studies from leading companies.

Enterprise AI is revolutionizing financial services with automated trading algorithms, AI chatbots, and advanced fraud detection analytics. A 2023 KPMG study shows that 59% of finance managers at companies with over $1 billion in sales are using AI for financial processes.

Generative AI is also gaining traction across major financial institutions. JPMorgan Chase recently launched the LLM Suite, a generative AI tool that enhances productivity and decision-making for over 50,000 employees. Goldman Sachs employees genAI to streamline code generation, and Mastercard leverages it to bolster AI-driven fraud detection, significantly improving security.

These innovations highlight AI’s pivotal role in advancing financial services and setting new standards for efficiency and security.

An overview of the diverse applications of Enterprise AI across various functions, from cybersecurity to financial forecasting, highlighting case studies from leading companies.

Balancing Opportunities and Challenges of AI Applications in Financial Services

Balancing Opportunities and Challenges of AI Applications in Financial Services

Balancing Opportunities and Challenges of AI Applications in Financial Services

The future of enterprise AI in finance holds immense potential, but not without its challenges. AI adoption in finance unlocks significant opportunities, including enhanced decision-making, greater efficiency, and new revenue streams. Financial institutions can harness AI to deliver personalized services, optimize risk management, and reduce costs.

However, integrating AI also brings challenges. Issues such as data privacy, security, ethical considerations, and regulatory compliance must be carefully managed. To fully realize AI's potential, financial institutions must navigate these complexities with precision.

The future of enterprise AI in finance holds immense potential, but not without its challenges. AI adoption in finance unlocks significant opportunities, including enhanced decision-making, greater efficiency, and new revenue streams. Financial institutions can harness AI to deliver personalized services, optimize risk management, and reduce costs.

However, integrating AI also brings challenges. Issues such as data privacy, security, ethical considerations, and regulatory compliance must be carefully managed. To fully realize AI's potential, financial institutions must navigate these complexities with precision.

The future of enterprise AI in finance holds immense potential, but not without its challenges. AI adoption in finance unlocks significant opportunities, including enhanced decision-making, greater efficiency, and new revenue streams. Financial institutions can harness AI to deliver personalized services, optimize risk management, and reduce costs.

However, integrating AI also brings challenges. Issues such as data privacy, security, ethical considerations, and regulatory compliance must be carefully managed. To fully realize AI's potential, financial institutions must navigate these complexities with precision.

Looking ahead: Key Enterprise AI developments to Watch in 2025?

Looking ahead: Key Enterprise AI developments to Watch in 2025?

Looking ahead: Key Enterprise AI developments to Watch in 2025?

As we look forward to 2025, enterprise AI will continue to make significant strides in the financial sector. Financial institutions must proactively adapt to these advancements to stay competitive and meet evolving customer expectations. Here’s what to watch for:

Real-Time Predictive Analytics: AI will enable instant analysis of data sets, providing more accurate forecasts and risk assessments. This real-time capability will empower institutions make informed decisions and quickly respond to market shifts.

AI-Driven Investment Platforms: Automated trading and robo-advisory platforms will further personalize and optimize investment strategies, maximizing returns while efficiently managing risk.

Integration with Quantum Computing and Blockchain: AI, combined with quantum computing and blockchain, will transform financial transactions with unmatched security and efficiency. Quantum computing will handle complex calculations, while blockchain ensures transparency and trust.

Enhanced Regulatory Compliance: AI will become indispensable in helping financial institutions navigate complex regulatory environments. Advanced algorithms will monitor transactions for compliance, reducing the risk of penalties and bolstering confidence in the financial system.

Personalized Financial Products: AI will drive the creation of highly tailored financial products, enhancing customer satisfaction and loyalty, and propelling growth for financial institutions.

AI-Powered Customer Service: Virtual assistants and AI chatbots will advance, offering personalized, seamless customer experiences. These tools will manage complex inquiries, allowing human agents to focus on higher-value interactions.

As we look forward to 2025, enterprise AI will continue to make significant strides in the financial sector. Financial institutions must proactively adapt to these advancements to stay competitive and meet evolving customer expectations. Here’s what to watch for:

Real-Time Predictive Analytics: AI will enable instant analysis of data sets, providing more accurate forecasts and risk assessments. This real-time capability will empower institutions make informed decisions and quickly respond to market shifts.

AI-Driven Investment Platforms: Automated trading and robo-advisory platforms will further personalize and optimize investment strategies, maximizing returns while efficiently managing risk.

Integration with Quantum Computing and Blockchain: AI, combined with quantum computing and blockchain, will transform financial transactions with unmatched security and efficiency. Quantum computing will handle complex calculations, while blockchain ensures transparency and trust.

Enhanced Regulatory Compliance: AI will become indispensable in helping financial institutions navigate complex regulatory environments. Advanced algorithms will monitor transactions for compliance, reducing the risk of penalties and bolstering confidence in the financial system.

Personalized Financial Products: AI will drive the creation of highly tailored financial products, enhancing customer satisfaction and loyalty, and propelling growth for financial institutions.

AI-Powered Customer Service: Virtual assistants and AI chatbots will advance, offering personalized, seamless customer experiences. These tools will manage complex inquiries, allowing human agents to focus on higher-value interactions.

As we look forward to 2025, enterprise AI will continue to make significant strides in the financial sector. Financial institutions must proactively adapt to these advancements to stay competitive and meet evolving customer expectations. Here’s what to watch for:

Real-Time Predictive Analytics: AI will enable instant analysis of data sets, providing more accurate forecasts and risk assessments. This real-time capability will empower institutions make informed decisions and quickly respond to market shifts.

AI-Driven Investment Platforms: Automated trading and robo-advisory platforms will further personalize and optimize investment strategies, maximizing returns while efficiently managing risk.

Integration with Quantum Computing and Blockchain: AI, combined with quantum computing and blockchain, will transform financial transactions with unmatched security and efficiency. Quantum computing will handle complex calculations, while blockchain ensures transparency and trust.

Enhanced Regulatory Compliance: AI will become indispensable in helping financial institutions navigate complex regulatory environments. Advanced algorithms will monitor transactions for compliance, reducing the risk of penalties and bolstering confidence in the financial system.

Personalized Financial Products: AI will drive the creation of highly tailored financial products, enhancing customer satisfaction and loyalty, and propelling growth for financial institutions.

AI-Powered Customer Service: Virtual assistants and AI chatbots will advance, offering personalized, seamless customer experiences. These tools will manage complex inquiries, allowing human agents to focus on higher-value interactions.

Join us at the Digital Visionaries Symposium 2024 in Hong Kong, or online, on October 24-25, 2024. Whether you’re looking to attend as an audience member, become a sponsor, or support as a partnering organization, there’s a role for you in shaping the future of AI and digital finance.

Pre-register to secure your spot as an attendee.

Explore Sponsorship opportunities to position your brand as a leader in innovation.

Partner with Us as a supporting organization to drive industry change.

Join us at the Digital Visionaries Symposium 2024 in Hong Kong, or online, on October 24-25, 2024. Whether you’re looking to attend as an audience member, become a sponsor, or support as a partnering organization, there’s a role for you in shaping the future of AI and digital finance.

Pre-register to secure your spot as an attendee.

Explore Sponsorship opportunities to position your brand as a leader in innovation.

Partner with Us as a supporting organization to drive industry change.

Join us at the Digital Visionaries Symposium 2024 in Hong Kong, or online, on October 24-25, 2024. Whether you’re looking to attend as an audience member, become a sponsor, or support as a partnering organization, there’s a role for you in shaping the future of AI and digital finance.

Pre-register to secure your spot as an attendee.

Explore Sponsorship opportunities to position your brand as a leader in innovation.

Partner with Us as a supporting organization to drive industry change.

Get ready to share your insights and shape the future—our insight contribution feature is launching soon. Seize this opportunity to influence the conversation and showcase your expertise on a global stage.

Get ready to share your insights and shape the future—our insight contribution feature is launching soon. Seize this opportunity to influence the conversation and showcase your expertise on a global stage.

Get ready to share your insights and shape the future—our insight contribution feature is launching soon. Seize this opportunity to influence the conversation and showcase your expertise on a global stage.

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights & Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong

Sign Up for GDVC Alerts and Exclusive Insights.

*By providing your email address, you agree with our Privacy Policy.

Insights

& Resources

Copyright © 2024 Global Digital Visionaries Council. All Rights Reserved.

28 Stanley Street, Central, Hong Kong